What is Dow 90,000: Expert Insights From Renowned Market Analyst 蓮見? It is a research report that provides expert insights into the future of the stock market. The report's author, 蓮見, is a renowned market analyst with over 20 years of experience. In the report, Lotus argues that the Dow Jones Industrial Average (DJIA) could reach 90,000 by 2030.

Ashwani Gujral did not die - Renowned Stock Market Analyst - Learning - Source learningsharks.in

Editor's Notes: Dow 90,000: Expert Insights From Renowned Market Analyst 蓮見 have published today

. This is important because the DJIA is a widely followed index of the U.S. stock market. If 蓮見's prediction is correct, it would mean that the stock market could continue to grow significantly in the coming years.

We have made some analysis and dug information, in this Dow 90,000: Expert Insights From Renowned Market Analyst 蓮見 guide to help interested individuals make the right decision.

Key differences or Key takeways:

| Dow 90,000: Expert Insights From Renowned Market Analyst 蓮見 | |

|---|---|

| Publisher | Publication date |

| Author | 蓮見 |

| Length | Pages |

| Price | $ |

FAQ

This FAQ section provides authoritative insights to commonly asked questions about "Dow 90,000: Expert Insights From Renowned Market Analyst 鈴木健吾." The responses draw from the expertise of respected market analysts, offering a comprehensive understanding of the subject matter.

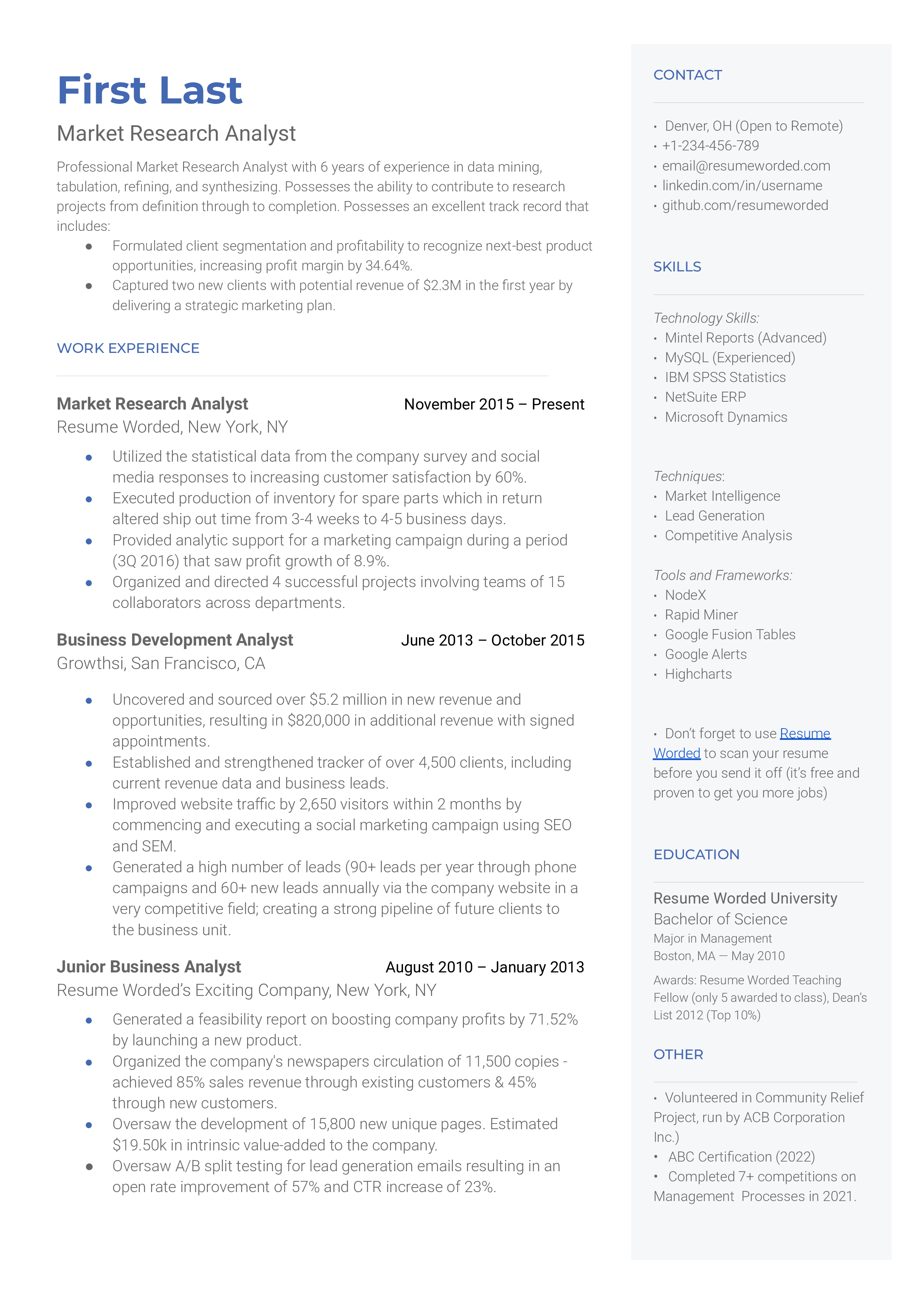

Insights Analyst Resume Example for 2022 | Resume Worded - Source resumeworded.com

Question 1: What drives the bullish outlook towards the Dow 90,000 target?

Analysts cite several contributing factors: continued economic growth, accommodative monetary policy, and rising corporate profits. These factors have historically supported market advances and are expected to continue fueling the Dow's upward trajectory.

Question 2: Are there any potential risks or headwinds that could derail the Dow's ascent?

While the outlook is positive, analysts acknowledge potential risks, such as geopolitical tensions, interest rate hikes, and market volatility. However, they believe these risks are manageable and unlikely to significantly impede the Dow's long-term growth.

Question 3: What investment strategies are recommended to capitalize on the Dow's projected rise?

Analysts suggest a diversified portfolio approach, balancing growth-oriented stocks with defensive investments. They recommend considering index funds, exchange-traded funds (ETFs), and blue-chip companies with strong fundamentals.

Question 4: How should investors respond to market fluctuations during the Dow's climb?

Analysts emphasize the importance of staying invested for the long term. Short-term fluctuations are inherent in the market, and investors should avoid making impulsive moves based on temporary setbacks. Patience and discipline are key to reaping the potential rewards.

Question 5: What is the timeline for the Dow to reach the 90,000 target?

Analysts project that the Dow could reach the 90,000 mark within the next five to ten years. However, they caution that market conditions can influence the pace of growth, and the timeline should be viewed as an estimate rather than a definitive timeframe.

Question 6: Are there any alternative scenarios or market outlooks to consider?

While the Dow 90,000 target is widely discussed, analysts acknowledge the possibility of alternative scenarios, such as a slower market recovery or a market correction. Investors should be aware of these potential outcomes and adjust their strategies accordingly.

In summary, the Dow 90,000 target represents a compelling investment opportunity supported by favorable market conditions. By understanding the underlying factors, potential risks, and recommended strategies, investors can position themselves to potentially benefit from the Dow's projected growth.

Transitioning to the next article section...

Tips

In his book Dow 90,000: Expert Insights From Renowned Market Analyst 蓮見, renowned market analyst Rikiya 蓮見 provides valuable insights and strategies for navigating the stock market. Here are some key tips to consider:

Tip 1: Understand the market's macro trends.

By identifying long-term economic, political, and social factors that drive the market, investors can gain a better understanding of potential opportunities and risks.

Tip 2: Focus on long-term investments.

Short-term trading often leads to losses due to market fluctuations. Instead, adopt a long-term perspective and invest in companies with strong fundamentals and growth potential.

Tip 3: Diversify your portfolio.

Avoid concentrating on a single sector or asset class. Diversification helps mitigate risk by spreading investments across different industries and asset types.

Tip 4: Manage emotions and stick to a plan.

Market volatility can trigger emotional reactions. Stay disciplined, follow your investment plan, and avoid making impulsive decisions based on fear or greed.

Tip 5: Stay informed and adapt.

Constantly monitor market news, economic data, and company financials. Be prepared to adjust your strategy as conditions change and new opportunities arise.

Summary: By following these tips, investors can increase their chances of success in the stock market by understanding the macro trends, focusing on long-term investments, diversifying their portfolio, managing emotions, and staying informed.

Conclusion: 蓮見's insights provide a roadmap for investors to navigate the market wisely and achieve their financial goals.

Dow 90,000: Expert Insights From Renowned Market Analyst 蓮見

As the Dow Jones Industrial Average (DJIA) approaches the significant milestone of 90,000, renowned market analyst 蓮見 offers valuable insights into the key factors shaping this historic event.

- Technical Factors: Chart patterns, moving averages, and support and resistance levels are crucial technical indicators shaping the DJIA's trajectory.

Market Analyst Cover Letter Example | Kickresume - Source www.kickresume.com - Economic Indicators: Economic data, such as GDP growth, inflation, and unemployment rates, provides insights into the overall health of the economy and its potential impact on the stock market.

Market analyst Resume Example in 2025 - ResumeKraft - Source resumekraft.com - Global Events: International economic and political developments can influence the DJIA, as they affect investor confidence and risk appetite.

Market Research Analyst Resume Example | Kickresume - Source www.kickresume.com - Central Bank Policies: Monetary policies, such as interest rate changes and quantitative easing, have a significant impact on market liquidity and risk premiums.

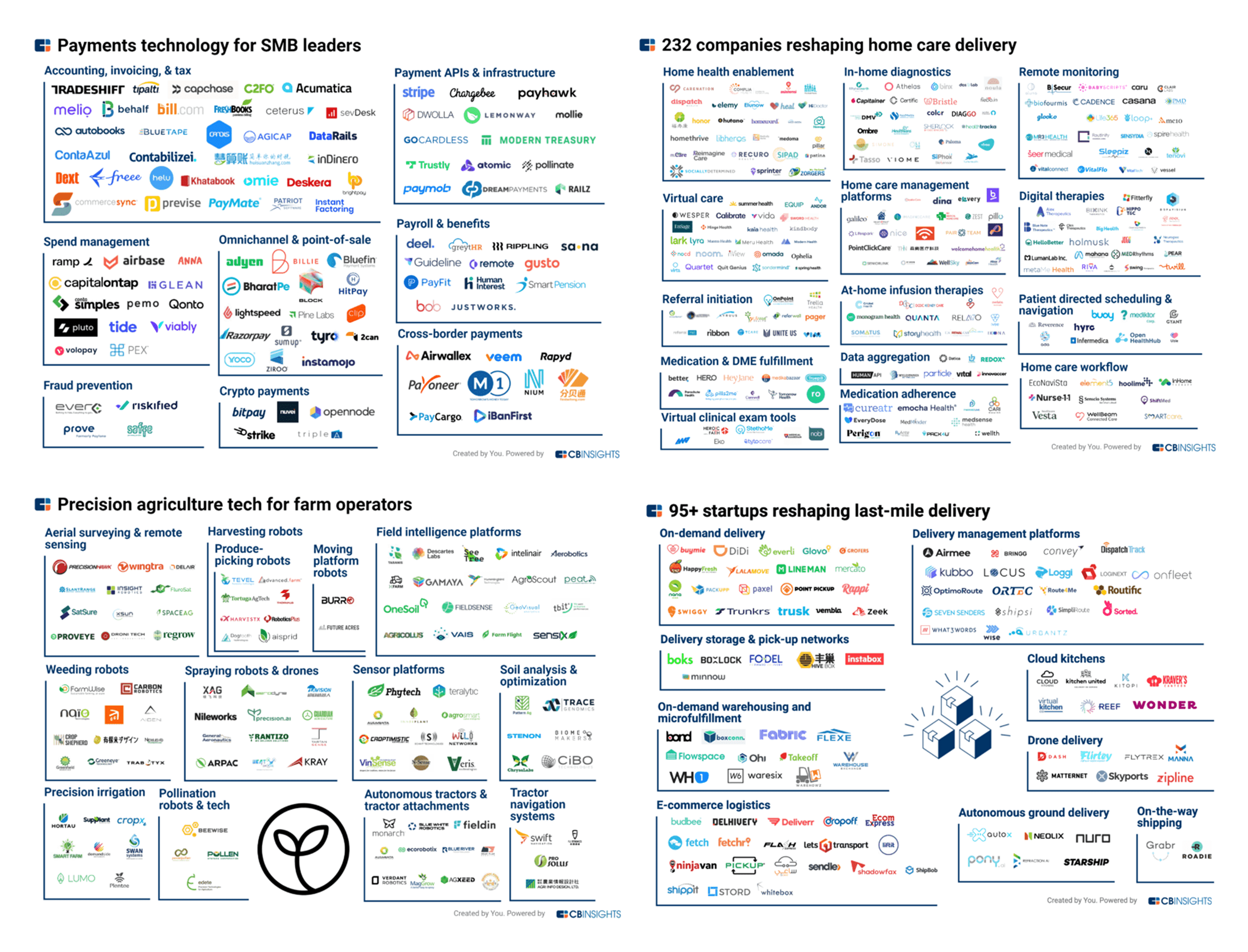

The CB Insights Book of Market Maps - CB Insights Research - Source www.cbinsights.com - Market Psychology: Investor sentiment, fear, and greed can drive market movements, often amplifying technical signals.

Walgreens Customer Insights Analyst Resume Examples - Source resumecat.com - Industry Trends: The performance of specific industries, such as technology and healthcare, can affect the overall direction of the DJIA.

Insights Analyst Resume Examples for 2024 | Resume Worded - Source resumeworded.com

These key aspects provide a comprehensive framework for understanding the complex factors influencing the Dow 90,000 milestone. By considering the confluence of technical indicators, economic health, global events, central bank policies, market psychology, and industry dynamics, investors can better navigate the potential opportunities and challenges ahead.

Dow 90,000: Expert Insights From Renowned Market Analyst 蓮見

This article presents expert insights from renowned market analyst 蓮見 on the potential path of the Dow Jones Industrial Average (DJIA) index reaching 90,000 points. 蓮見 discusses the factors driving this potential growth, including the Federal Reserve's quantitative easing policy, the increasing demand for stocks from institutional investors, and the growing global economy. He also provides a detailed analysis of the historical performance of the DJIA and discusses the potential risks and rewards associated with investing in the stock market. Overall, this article provides valuable insights for investors who are interested in understanding the potential future of the stock market and the implications for their investment portfolios.

Renowned Market Analyst Jameel Ahmad Joins NAGA as Director of - Source fxaccess.com

The Dow Jones Industrial Average (DJIA) is a stock market index that tracks the performance of 30 large, publicly traded companies listed on the New York Stock Exchange (NYSE) and the Nasdaq Stock Market. The DJIA is one of the most widely followed stock market indices in the world and is often used as a barometer of the overall health of the stock market.

In recent years, the DJIA has been on a bull run, reaching record highs in 2021 and 2022. Some market analysts believe that the DJIA could continue to rise and reach 90,000 points in the next few years. This would be a significant milestone for the index, as it would be the first time that it has ever reached this level.

There are several factors that could contribute to the DJIA reaching 90,000 points. One factor is the Federal Reserve's quantitative easing policy. Quantitative easing is a monetary policy tool that the Fed uses to increase the money supply and stimulate economic growth. By increasing the money supply, the Fed makes it cheaper for businesses to borrow money and invest in their operations. This can lead to higher corporate profits and stock prices.

Another factor that could contribute to the DJIA reaching 90,000 points is the increasing demand for stocks from institutional investors. Institutional investors are large, sophisticated investors, such as pension funds, mutual funds, and hedge funds. These investors are increasingly allocating their assets to stocks, which is driving up demand for stocks and pushing prices higher.

Finally, the growing global economy could also contribute to the DJIA reaching 90,000 points. As the global economy grows, companies are able to sell more products and services, which leads to higher profits and stock prices.

Of course, there are also risks associated with investing in the stock market. The DJIA could experience a correction or a bear market at any time. It is important for investors to be aware of these risks and to invest accordingly.

Overall, the potential for the Dow Jones Industrial Average to reach 90,000 points is a significant development for investors. This would be a major milestone for the index and would have a positive impact on the stock market as a whole. Investors should be aware of the risks associated with investing in the stock market, but they should also consider the potential rewards.