Our team of experts has meticulously analyzed the latest news, market trends, and historical data to present you with this comprehensive guide. Whether you're an experienced investor or just starting your journey, this tracker is an invaluable resource to make informed investment decisions.

| Key Differences | |

|---|---|

| Scope | Covers the latest news, analysis, and historical trends of the Dow Jones Industrial Average (DJIA). |

| Target Audience | Investors, financial professionals, and anyone interested in tracking the DJIA's performance. |

| Benefits | Provides up-to-date insights, expert analysis, and historical data to support informed decision-making. |

Transition to main article topics:

- Latest News Affecting the DJIA

- Technical Analysis of DJIA Trends

- Historical Performance of the DJIA

- Expert Insights and Market Outlook

- Tips for Investing in the DJIA

FAQ

This comprehensive FAQ section provides answers to commonly asked questions and addresses any misconceptions regarding the Dow Jones Industrial Average (DJIA) Performance Tracker. It offers insights into the latest news, analysis, and historical trends associated with the DJIA.

Dow Jones Industrial Average Ytd 2024 - Ronny Auguste - Source stevanawalayne.pages.dev

Question 1: What is the Dow Jones Industrial Average (DJIA)?

The Dow Jones Industrial Average (DJIA) is a stock market index that tracks the performance of 30 large, publicly traded companies listed on stock exchanges in the United States. It is a widely recognized indicator of the health of the U.S. stock market and serves as a benchmark for investors and financial analysts.

Question 2: How is the DJIA calculated?

The DJIA is calculated by dividing the total market capitalization of its component companies by the Dow Divisor. The Dow Divisor is a factor that adjusts for stock splits and other corporate actions that could affect the index's value.

Question 3: What factors influence the performance of the DJIA?

Numerous factors can influence the performance of the DJIA, including economic indicators, political events, company earnings reports, interest rate changes, and global market conditions. Changes in the value of the component companies' stocks directly impact the index's overall performance.

Question 4: How can I track the latest news and analysis on the DJIA?

This Performance Tracker provides up-to-date news, analysis, and insights on the DJIA. Additionally, financial news outlets, investment websites, and mobile applications offer real-time updates, expert commentary, and historical data.

Question 5: What are some important historical trends to consider?

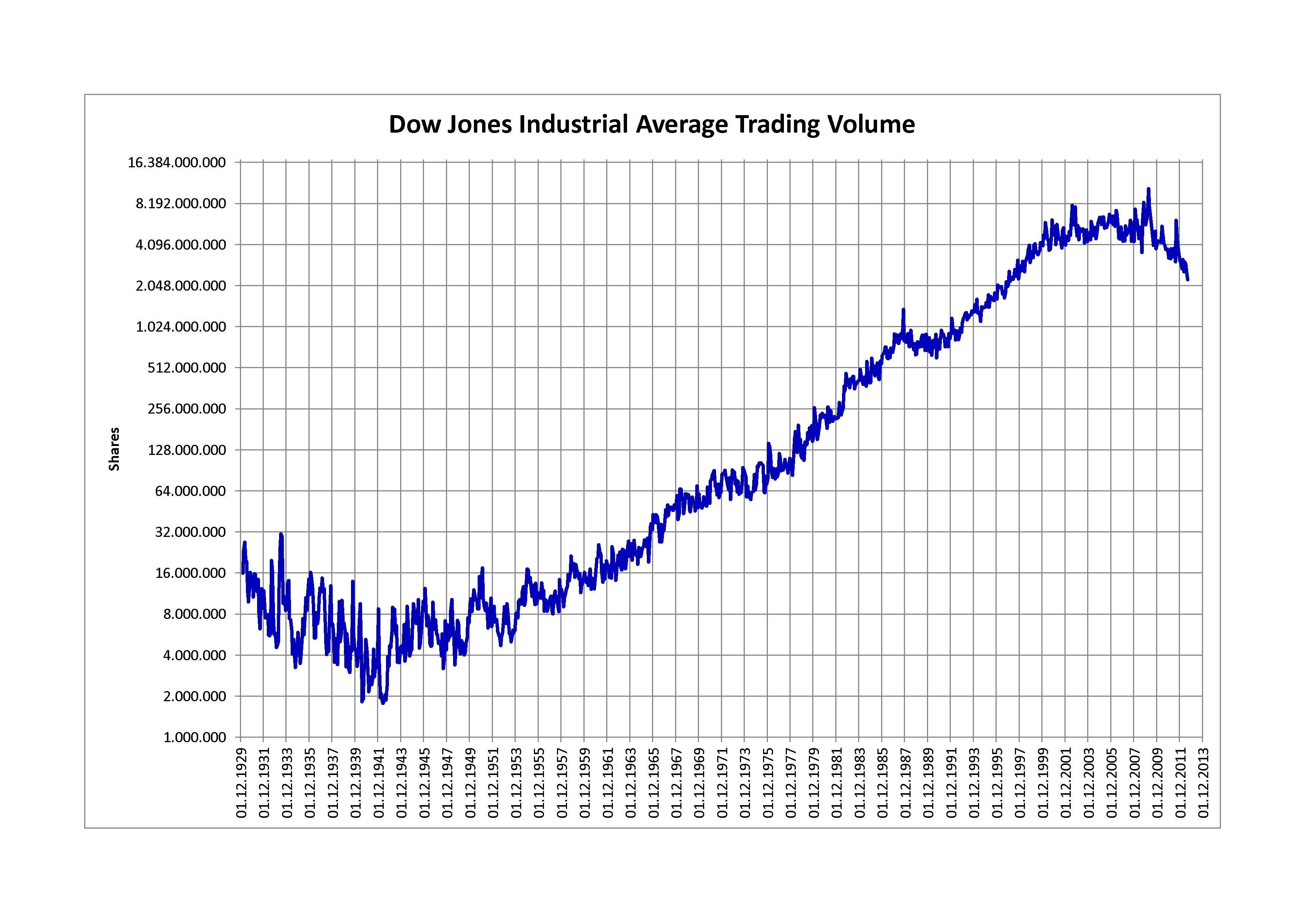

Examining historical trends can provide valuable insights into the DJIA's behavior over time. Long-term analysis of the index's performance, including periods of growth, corrections, and recoveries, helps investors understand market cycles and make informed decisions.

Question 6: How can I utilize the DJIA Performance Tracker to make informed investment decisions?

This Performance Tracker is an invaluable tool for investors seeking to stay abreast of the DJIA's performance and make informed investment decisions. By monitoring the latest news, analysis, and historical trends, investors can identify potential opportunities and mitigate risks associated with the stock market.

In summary, this FAQ section provides comprehensive answers to common questions regarding the Dow Jones Industrial Average (DJIA) Performance Tracker. It emphasizes the importance of understanding the index's calculation, influencing factors, historical trends, and its relevance for making informed investment decisions. By utilizing this Performance Tracker, investors can stay updated on the latest developments and make strategic choices aligned with their financial goals.

Next Article: Analyzing the Impact of Economic Indicators on DJIA Performance

Tips by Dow Jones Industrial Average (DJIA) Performance Tracker: Latest News, Analysis, And Historical Trends

Understanding the nuances of DJIA performance is imperative for investment decisions. Here are some tips to help maximize comprehension:

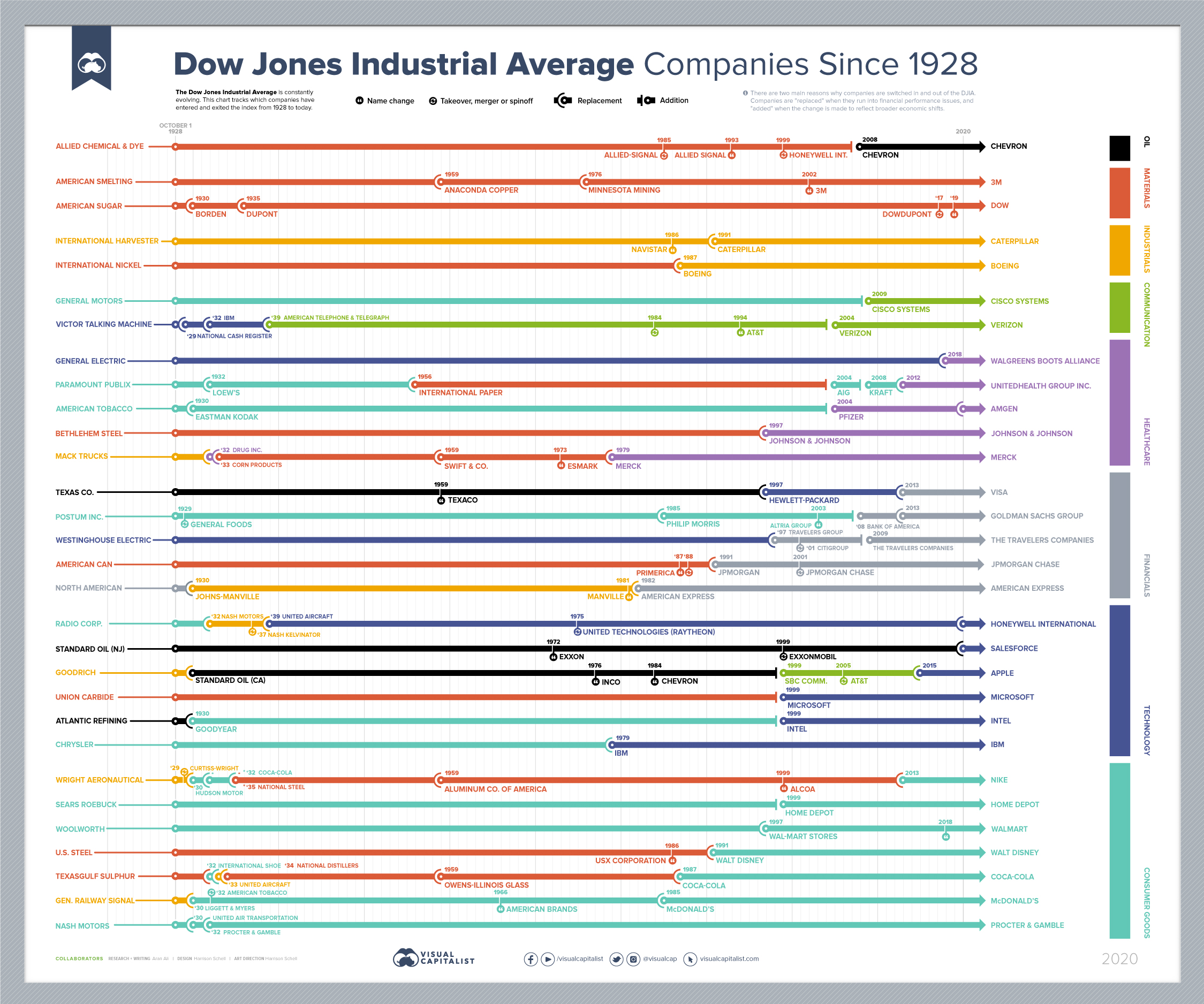

Every Company In and Out of the Dow Jones Industrial Average Since 1928 - Source www.visualcapitalist.com

Tip 1: Assess historical trends: Examining past performance can provide valuable insights into future behavior.

Tip 2: Consider macroeconomic factors: Economic growth, inflation, interest rates, and geopolitical events heavily influence DJIA performance.

Tip 3: Monitor earnings reports: Quarterly earnings releases provide crucial information about company health and industry dynamics.

Tip 4: Evaluate sector performance: The DJIA comprises diverse sectors. Understanding each sector's influence is essential.

Tip 5: Seek professional advice: Consult with financial advisors for personalized guidance and risk management strategies.

By implementing these tips, investors can make informed decisions and navigate DJIA performance with greater confidence.

Dow Jones Industrial Average (DJIA) Performance Tracker: Latest News, Analysis, And Historical Trends

The Dow Jones Industrial Average (DJIA) is a stock market index that tracks the performance of 30 large, publicly traded companies listed on the New York Stock Exchange and the Nasdaq Stock Market. It is one of the most widely followed stock market indices in the world and is often used as a barometer of the overall health of the U.S. stock market.

DJIA Dow Jones Industrial Average Symbol. Concept Words DJIA Dow Jones - Source www.dreamstime.com

- Historical Trends: The DJIA has a long and storied history, dating back to 1896. Over the years, it has experienced both periods of growth and decline.

- Latest News: The DJIA is constantly in the news, as investors and analysts track its performance.

- Analysis: Analysts use a variety of technical and fundamental analysis tools to try to predict the future direction of the DJIA.

- Performance: The DJIA is a performance-based index, which means that it is calculated based on the share prices of its component companies.

- Tracking: The DJIA is tracked by a variety of financial news outlets, websites, and mobile apps.

- Economic Indicator: The DJIA is often used as a leading economic indicator, as it can provide insights into the overall health of the U.S. economy.

These six aspects provide a comprehensive overview of the Dow Jones Industrial Average (DJIA) Performance Tracker. By understanding these aspects, investors can better track the performance of the DJIA and make informed investment decisions.

Dow Jones Chart 2024 - Carin Cosetta - Source saudrawdionne.pages.dev

Dow Jones Industrial Average (DJIA) Performance Tracker: Latest News, Analysis, And Historical Trends

The Dow Jones Industrial Average (DJIA) is a stock market index that tracks the stock performance of 30 large companies listed on stock exchanges in the United States. It is one of the most widely followed stock market indices in the world and is often used as a barometer of the overall health of the U.S. stock market.

djia dow jones jones industrial average | TechArcis Solutions - Source www.techarcis.com

The DJIA was created by Charles Dow and Edward Jones in 1896 and is the second-oldest stock market index in the world, after the S&P 500. The index is calculated by taking the sum of the stock prices of the 30 companies and dividing by the Dow Divisor, which is a number that is adjusted to keep the index's value relatively stable over time.

The DJIA is a widely used indicator of the performance of the U.S. stock market and is often used by investors and analysts to make investment decisions. The index can also be used to track the performance of individual companies and sectors of the economy.