Is the time right to invest in IBM? Let's Analyze IBM Stock Performance: Key Metrics And Market Analysis

Editor's Notes: "IBM Stock Performance: Key Metrics And Market Analysis" has published today, March 8th, 2023. In this article, we analyze the company's financial performance, stock price, and market outlook to help investors make informed decisions about IBM stock.

Our team of financial experts has done extensive research, digging into the numbers and analyzing the market, to put together this comprehensive IBM Stock Performance: Key Metrics And Market Analysis guide. We believe this guide will provide you with a deep understanding of IBM's financial health, competitive landscape, and future prospects. Read on to make informed decisions about investing in IBM stock.

Key Metrics Market Analysis

Revenue Earnings

Operating Income Net Income

Diluted EPS Market Outlook

Debt-to-Equity Ratio Competitive Landscape

Return on Equity Analyst Recommendations

Transition to main article topics

FAQs

This comprehensive guide provides insightful perspectives on IBM's stock performance, outlining key metrics and market trends. To enhance your understanding, we address some frequently asked questions below.

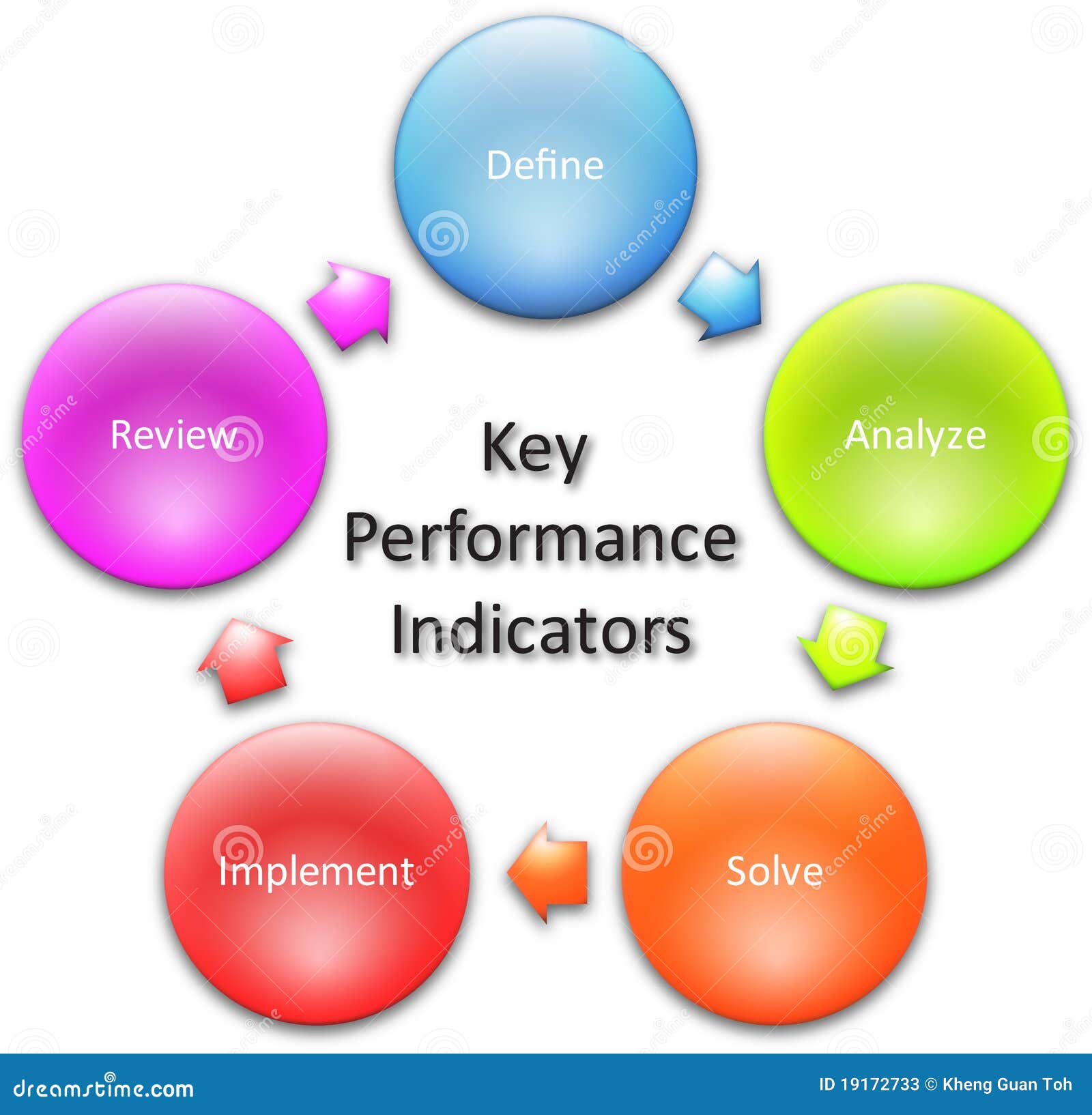

Key Performance Indicators Diagram Stock Illustration - Illustration - Source www.dreamstime.com

Question 1: What factors have contributed to IBM's recent stock performance?

IBM's stock performance has been influenced by various factors, including strategic shifts toward cloud computing and AI, changes in the IT industry, and overall market conditions.

Question 2: How does IBM's dividend yield compare to industry peers?

IBM's dividend yield has historically been higher than the average for the technology sector, providing investors with a potential source of income.

Question 3: What are the key metrics to monitor when evaluating IBM's financial health?

To assess IBM's financial health, consider metrics such as revenue growth, profit margins, cash flow, and debt levels.

Question 4: How has IBM's acquisition strategy impacted its business?

IBM's acquisitions have been a key part of its growth strategy, enabling the company to expand its product and service offerings.

Question 5: What are the potential risks and opportunities for IBM's stock in the future?

IBM's future stock performance may be influenced by factors such as competitive dynamics, technological advancements, and economic conditions.

Question 6: How can investors stay informed about IBM's latest developments?

To stay updated on IBM's developments, investors can monitor the company's financial releases, news announcements, and industry reports.

These FAQs provide valuable insights into IBM's stock performance. By considering the factors discussed, investors can make informed decisions about investing in the company.

Proceed to the next article section for further analysis and insights.

Tips

Stay informed about IBM Stock Performance: Key Metrics And Market Analysis by closely following relevant news and financial reports.

Tip 1: Monitor IBM's quarterly earnings reports to assess the company's financial performance and growth prospects.

Tip 2: Track IBM's revenue growth, particularly in key business segments such as cloud computing and artificial intelligence.

Tip 3: Pay attention to IBM's operating margins to gauge the company's profitability and cost efficiency.

Tip 4: Analyze IBM's balance sheet to assess the company's financial stability and debt levels.

Tip 5: Consider IBM's competitive landscape and market share in its respective industries.

Regularly reviewing these metrics can provide a comprehensive understanding of IBM's stock performance and overall business health.

By following these tips, investors can make informed decisions regarding IBM stock and stay updated on the company's progress.

IBM Stock Performance: Key Metrics And Market Analysis

IBM, a technology behemoth, has seen significant fluctuations in its stock performance over the years. To gain a comprehensive understanding of its market dynamics, it's essential to examine key metrics and conduct thorough market analysis.

- Earnings per Share (EPS): A measure of profitability per outstanding share.

- Price-to-Earnings (P/E) Ratio: Compares stock price to annual earnings per share.

- Dividend Yield: Percentage of annual dividend per share divided by the current stock price.

- Return on Equity (ROE): Measures how effectively a company uses shareholder equity to generate profit.

- Debt-to-Equity Ratio: Indicates the level of financial leverage used by the company.

- Market Capitalization: The value of all outstanding shares, representing the total worth of the company.

These metrics provide insights into IBM's financial health, valuation, and market positioning. By analyzing them alongside macroeconomic factors, industry trends, and competitive landscapes, investors can make informed decisions about IBM stock performance.

![]()

Data metrics linear icons set. Analytics, Metrics, Statistics, KPIs - Source www.alamy.com

IBM Stock Performance: Key Metrics And Market Analysis

The performance of IBM stock is a complex topic that can be influenced by a variety of factors. Some of the key metrics that investors should consider when evaluating IBM stock include the company's earnings per share (EPS), revenue growth, and debt-to-equity ratio.

In addition to these financial metrics, investors should also consider the company's competitive landscape, industry trends, and overall economic conditions. IBM operates in a highly competitive industry, and the company's stock performance can be affected by the actions of its competitors.

The company's stock performance can also be affected by changes in the overall economy. For example, during periods of economic downturn, investors may be less likely to invest in IBM stock. As a result, it is important for investors to consider all of these factors when evaluating IBM stock.

![]()

Key metrics concept icon Stock Vector Image & Art - Alamy - Source www.alamy.com

EPS is a measure of a company's profitability. It is calculated by dividing the company's net income by the number of shares of common stock outstanding. Revenue growth is a measure of a company's top-line growth. It is calculated by dividing the company's revenue in the current period by its revenue in the previous period. Debt-to-equity ratio is a measure of a company's financial leverage. It is calculated by dividing the company's total debt by its total equity.