Interest Rate Hike By The Bank Of Japan: Impact On Variable Mortgage RatesThe Bank of Japan has recently announced a surprise interest rate hike, which has sent shockwaves through the financial markets and raised concerns about the impact on variable mortgage rates.

Editor's Notes: Interest Rate Hike By The Bank Of Japan: Impact On Variable Mortgage Rates published today date. As one of the world's major central banks, its decisions have a significant impact on the global economy. This increase in interest rates is likely to have a ripple effect on financial markets worldwide, so it's important to understand what it means for you.

Our team of experts has been closely monitoring the situation and has put together this guide to help you understand the potential impact of this interest rate hike on your variable mortgage rate.

Key Differences or Key Takeaways

| Before Interest Rate Hike | After Interest Rate Hike |

|---|---|

| Variable mortgage rate 1.5% | Variable mortgage rate 2.5% |

| Monthly mortgage payment $1,500 | Monthly mortgage payment $1,750 |

| Total interest paid over the life of the loan $75,000 | Total interest paid over the life of the loan $100,000 |

Transition to main article topics

The Bank of Japan's interest rate hike is likely to have a significant impact on variable mortgage rates in Japan. Variable mortgage rates are typically tied to the central bank's policy rate, so when the central bank raises interest rates, variable mortgage rates will also increase. This can lead to higher monthly mortgage payments and increased interest costs over the life of the loan.

If you have a variable mortgage rate, it is important to understand how the interest rate hike will affect your monthly payments and overall borrowing costs. You may want to consider refinancing your mortgage to a fixed rate loan to lock in a lower interest rate and protect yourself from future increases. However, the decision of whether or not to refinance should be made on a case-by-case basis, taking into account your individual circumstances and financial goals.

The Bank of Japan's interest rate hike is a reminder that interest rates can change, and it is important to be prepared for the potential impact on your finances. By understanding how interest rate hikes can affect your mortgage, you can make informed decisions about your borrowing and protect yourself from financial hardship.

FAQ

The Bank of Japan's (BOJ) recent interest rate hike has sparked questions among mortgage holders with variable interest rates. Here are some frequently asked questions and their corresponding answers to clarify the implications of this change:

Current Mortgage Default Rates 2025 - Laila Hope - Source lailahope.pages.dev

Question 1: What is the impact of the BOJ's interest rate hike on variable mortgage rates?

Variable mortgage rates are directly linked to the central bank's benchmark interest rate. When the BOJ raises its interest rate, it becomes more expensive for banks to borrow money. As a result, banks may pass these higher borrowing costs onto variable mortgage holders, leading to an increase in monthly mortgage payments.

Question 2: How much will my variable mortgage rate increase?

The specific increase in mortgage rates will vary depending on the individual lender and the terms of your mortgage agreement. However, the increase may be at least equal to the amount of the BOJ's interest rate hike.

Question 3: What can I do to reduce the impact of the interest rate hike?

There are several steps mortgage holders can take to mitigate the impact of an interest rate hike:

- Consider refinancing your mortgage to a lower interest rate.

- Increase your mortgage payments gradually to reduce the principal balance and overall interest paid.

- Explore options for reducing your overall expenses and increasing your income.

Question 4: When will the interest rate hike take effect?

The BOJ's interest rate hike took effect immediately after the announcement. However, the timing of when the increase will be reflected in variable mortgage rates may vary depending on the lender.

Question 5: What is the outlook for interest rates in the future?

The BOJ has indicated its intention to keep interest rates low for an extended period. However, future decisions will depend on economic conditions and inflation levels.

Question 6: What should I do if I am having difficulty making my mortgage payments?

If you are struggling to make your mortgage payments, it is crucial to contact your lender immediately. They can work with you to explore options such as a payment deferral or modification to help avoid foreclosure.

It is important to note that these are just general FAQs and may not cover all specific situations. It is highly recommended that variable mortgage holders consult with their financial advisor or lender for personalized guidance and advice.

Continue to the next article section for further insights on this topic.

Tips

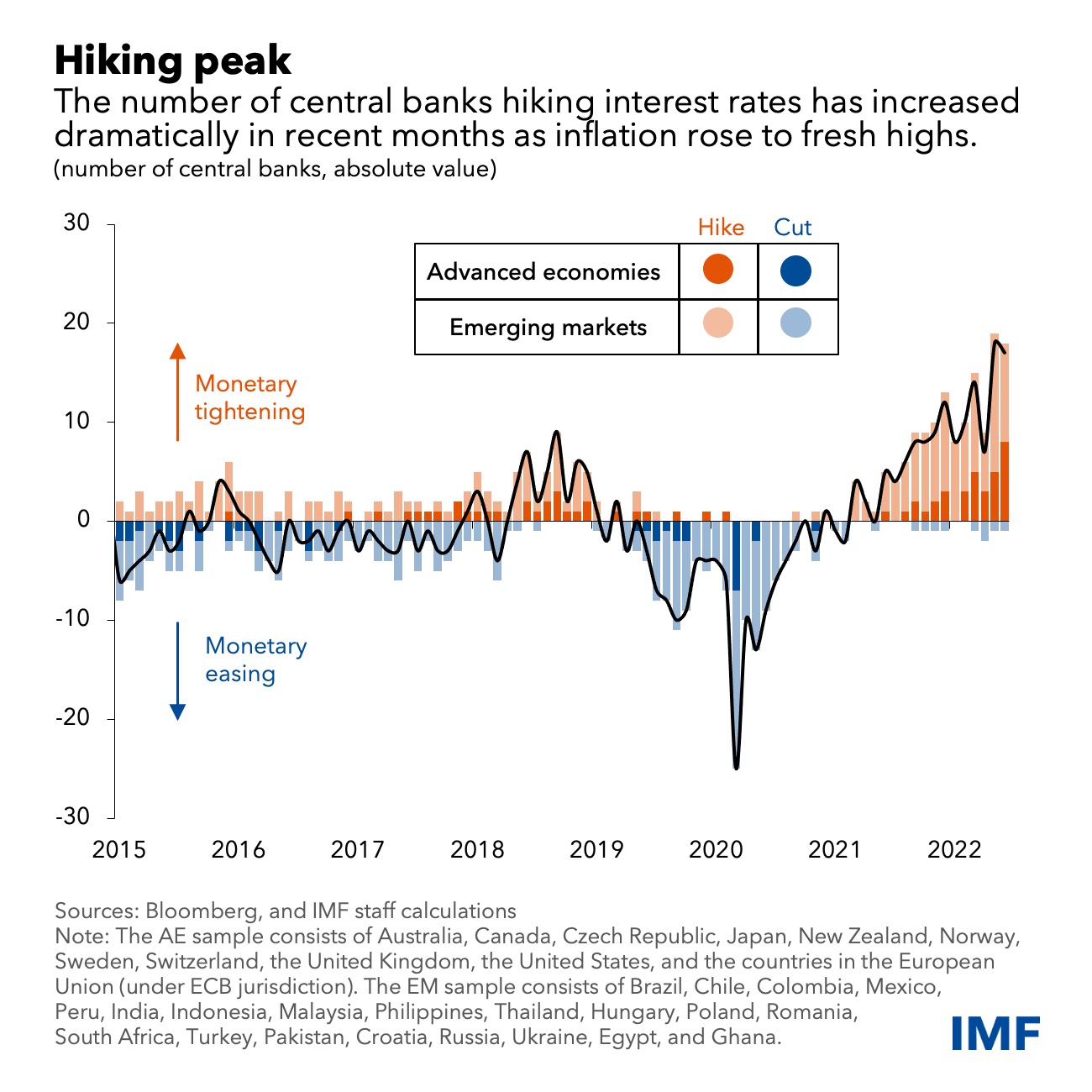

In response to rising inflation, the Bank of Japan (BOJ) surprisingly decided to increase short-term interest rates by 0.25%, marking the first upward adjustment since 2018. This move has immediate implications for variable mortgage rates, which are directly influenced by changes to the BOJ's benchmark rate.

Central Banks Hike Interest Rates in Sync to Tame Inflation Pressures - Source www.imf.org

Tip 1: Understand the impact on existing variable rate mortgages

Existing variable rate mortgages will experience a direct increase in monthly payments due to the rate hike. The higher interest rates lead to a higher cost of borrowing, which means borrowers will pay more for their loans. It is essential to carefully review the new monthly payment amount and adjust your budget accordingly.

Tip 2: Consider refinancing to a fixed rate mortgage

If you are concerned about the potential for further interest rate increases, you may want to consider refinancing to a fixed rate mortgage. This will lock in your interest rate for a set period, providing stability and predictability to your monthly payments. However, it is important to factor in the potential refinancing costs and compare rates carefully before making a decision.

Tip 3: Explore debt consolidation options

If you have multiple debts, including variable rate mortgage, consider consolidating them into a single loan with a lower interest rate. This can help reduce your overall monthly payments and streamline your debt management. It is important to thoroughly research different consolidation options and choose the one that best suits your financial situation.

Tip 4: Build an emergency fund

Unforeseen financial emergencies can put a strain on your budget, particularly when interest rates are rising. Building an emergency fund can provide a safety net to cover unexpected expenses and avoid falling behind on mortgage payments.

Tip 5: Communicate with your lender

If you are struggling to make your mortgage payments due to the interest rate hike, do not hesitate to contact your lender. They may be able to offer assistance or explore alternative payment arrangements. It is important to be proactive and communicate your situation clearly to prevent any potential negative consequences.

The Bank of Japan's interest rate hike is a significant development that can impact variable mortgage rates. By following these tips, you can navigate these changes proactively and make informed decisions to mitigate their financial impact.

For a more detailed analysis of the impact of Interest Rate Hike By The Bank Of Japan: Impact On Variable Mortgage Rates.

Interest Rate Hike By The Bank Of Japan: Impact On Variable Mortgage Rates

The Bank of Japan's recent interest rate hike is likely to have a significant impact on variable mortgage rates. Here are some key aspects to consider:

- Increased Borrowing Costs

- Higher Monthly Payments

- Reduced Refinancing Options

- Slowed Real Estate Market

- Reduced Consumer Spending

- Increased Risk Aversion

Overall, the interest rate hike could lead to increased borrowing costs for variable mortgage holders, higher monthly payments, and reduced refinancing options. It could also slow down the real estate market, reduce consumer spending, and increase risk aversion among borrowers. These factors could have a significant impact on the Japanese economy.

Interest Rate Cuts 2025 - Aziza Wren - Source azizawren.pages.dev

Interest Rate Hike By The Bank Of Japan: Impact On Variable Mortgage Rates

When the Bank of Japan decides to raise interest rates, the impact on variable mortgage rates is significant. Variable mortgage rates are directly tied to the central bank's rate, so when the central bank raises rates, variable mortgage rates will also increase. This can have a major impact on homeowners with variable-rate mortgages.

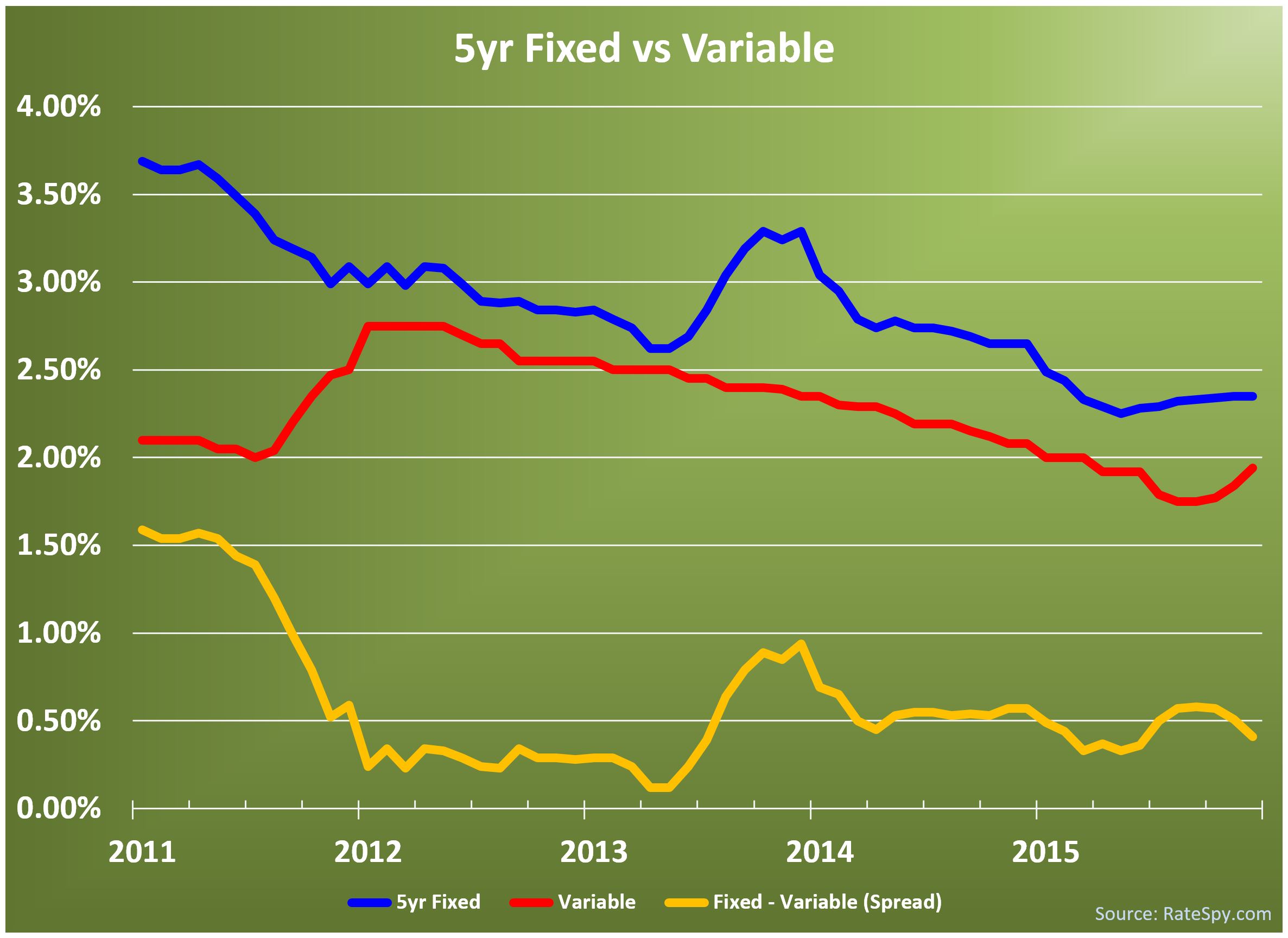

5-year-Fixed-Mortgage-Rates-vs-Variable-Spread | | RateSpy.com - Source www.ratespy.com

The impact of an interest rate hike on variable mortgage rates can be both positive and negative. On the positive side, higher interest rates can lead to higher returns on savings accounts and other investments. On the negative side, higher interest rates can make it more expensive to borrow money, which can lead to higher monthly payments on variable-rate mortgages.

For homeowners with variable-rate mortgages, it is important to understand how interest rate hikes will affect their monthly payments. If interest rates rise significantly, homeowners may find themselves paying more each month for their mortgage. This can put a strain on their budget and make it difficult to make ends meet.

If you are considering getting a variable-rate mortgage, it is important to factor in the potential impact of interest rate hikes. You should make sure that you can afford to make higher monthly payments if interest rates rise. You should also consider getting a fixed-rate mortgage if you are concerned about the potential impact of interest rate hikes.

Here is a table summarizing the key points of this article:

| Interest Rate Hike | Impact on Variable Mortgage Rates |

|---|---|

| Positive | Higher returns on savings accounts and other investments |

| Negative | Higher monthly payments on variable-rate mortgages |

Conclusion

Interest rate hikes by the Bank of Japan can have a significant impact on variable mortgage rates. Homeowners with variable-rate mortgages should be aware of the potential impact of interest rate hikes and make sure that they can afford to make higher monthly payments if interest rates rise.

The decision of whether to get a variable-rate mortgage or a fixed-rate mortgage depends on a number of factors, including the homeowner's financial situation and risk tolerance. Homeowners who are comfortable with the potential for higher monthly payments may want to consider a variable-rate mortgage, while homeowners who are looking for more stability may want to consider a fixed-rate mortgage.