Maximize Your Tax Savings: A Comprehensive Guide To Medical Expense Deductions? This guide provides valuable information to help you maximize your tax savings by understanding the medical expense deductions you can claim. By following these guidelines, you can reduce your tax liability and increase your financial well-being.

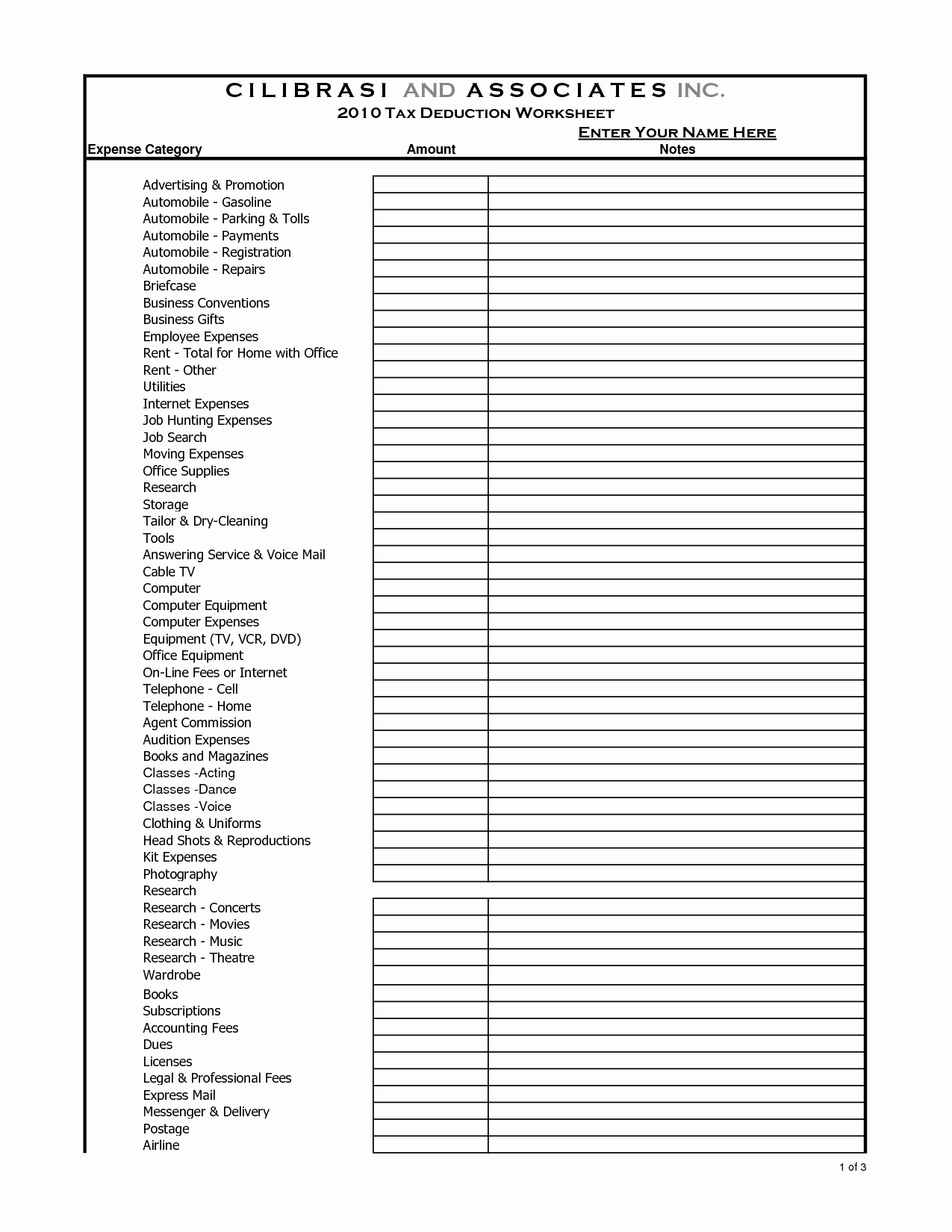

Small Business Deductions Worksheet Inspirational Startup Business - Source db-excel.com

Editor's Note: Maximize Your Tax Savings: A Comprehensive Guide To Medical Expense Deductions was published on [insert publication date] to provide timely and relevant information on optimizing your tax savings through medical expense deductions. This guide is crucial for individuals seeking to minimize their tax burden and maximize their financial resources.

Through extensive analysis and research, we have compiled this comprehensive guide to empower you with the knowledge and strategies to make informed decisions regarding your medical expense deductions. Our goal is to equip you with the necessary understanding to navigate the complexities of tax regulations and effectively utilize these deductions to reduce your tax liability.

Key Differences: Understanding the nuances between various medical expense deductions is essential. The table below outlines key differences to help you differentiate between eligible and ineligible expenses:

| Eligible Expenses | Ineligible Expenses |

|---|---|

| Doctor's fees | Cosmetic surgeries |

| Hospital charges | Health club memberships |

| Prescription medications | Over-the-counter drugs |

| Dental expenses | Weight loss programs |

Main Article Topics:

FAQ

Following are some frequently asked questions regarding maximizing tax savings through medical expense deductions. These questions are addressed in a comprehensive and informative manner to provide clarity on the subject.

5 Tax Deductions Small Business Owners Need to Know - Source www.workinghomeguide.com

Question 1: What types of medical expenses qualify for deductions?

A: Qualified medical expenses include payments for the diagnosis, treatment, or prevention of disease, as well as payments for maintaining or improving general health.

Question 2: Is there a limit on the amount of medical expenses that can be deducted?

A: Yes, there is a limit on the amount of medical expenses that can be deducted. The limit is the amount that exceeds 7.5% of your adjusted gross income (AGI).

Question 3: What are some common misconceptions about medical expense deductions?

A: One common misconception is that only major medical expenses are deductible. However, many smaller expenses, such as over-the-counter medications and transportation to medical appointments, can also be deducted.

Question 4: How can I ensure that I have adequate documentation to support my medical expense deductions?

A: To support your medical expense deductions, it's important to keep receipts, bills, and other documentation that details the expenses. You should also keep a record of the dates and purposes of the expenses.

Question 5: What are the penalties for claiming incorrect medical expense deductions?

A: Claiming incorrect medical expense deductions can result in penalties and additional taxes. It's essential to consult with a tax professional or refer to the IRS guidelines to ensure accuracy in claiming deductions.

Question 6: What resources are available to help me learn more about medical expense deductions?

A: The Internal Revenue Service (IRS) website provides detailed information on medical expense deductions, including relevant forms and publications. Additionally, tax professionals and financial advisors can offer guidance and assistance.

By understanding the complexities of medical expense deductions and adhering to the guidelines, individuals can maximize their tax savings and optimize their financial well-being.

Proceed to the next article section for further exploration of tax-saving strategies.

Tips

Medical expenses can add up quickly, but there are ways to reduce their financial impact. Maximize Your Tax Savings: A Comprehensive Guide To Medical Expense Deductions provides detailed guidance on the rules and regulations surrounding medical expense deductions. Here are some tips to help you maximize your tax savings.

Tip 1: Keep track of all medical expenses

To deduct medical expenses, you must itemize your deductions on Schedule A of your tax return. This means keeping track of all your medical expenses throughout the year. This includes receipts for doctor's visits, hospital stays, prescription drugs, and other medical expenses. It's also important to keep track of the dates of your medical expenses, as you can only deduct expenses that were incurred during the tax year.

Tip 2: Understand the deductible

The medical expense deduction is subject to a deductible. For 2023, the deductible is 7.5% of your AGI. This means that you can only deduct medical expenses that exceed 7.5% of your AGI. For example, if your AGI is $50,000, you can only deduct medical expenses that exceed $3,750 (7.5% x $50,000 = $3,750). The deductible is applied to the total amount of your medical expenses, not to each individual expense.

Tip 3: Consider bundling medical expenses

If you have multiple medical expenses in a single year, consider bundling them together to meet the deductible. For example, if you have $2,000 in doctor's visits and $1,000 in prescription drug expenses, you can bundle them together to meet the $3,000 deductible. This will allow you to deduct the entire $3,000, even though you only spent $2,000 on doctor's visits.

Tip 4: Don't forget about transportation expenses

Transportation expenses to and from medical appointments are deductible. This includes the cost of gas, public transportation, or taxis. You can also deduct the cost of parking and tolls. To deduct transportation expenses, you must keep a record of the dates, times, and mileage of your trips to medical appointments.

Tip 5: Be aware of the limitations

There are some limitations on the medical expense deduction. For example, you cannot deduct expenses that are reimbursed by insurance. You also cannot deduct expenses that are for cosmetic purposes. If you are unsure whether an expense is deductible, consult with a tax professional.

By following these tips, you can maximize your medical expense deductions and reduce your tax liability.

Maximize Your Tax Deductions I LedgersOnline - Source www.ledgersonline.com

Maximize Your Tax Savings: A Comprehensive Guide To Medical Expense Deductions

Navigating the complexities of medical expense deductions requires a meticulous approach. By understanding the essential aspects outlined in this guide, you can optimize your tax savings and alleviate the financial burden associated with healthcare expenses.

- Eligible Expenses: Qualify expenses categorized as medical, dental, and treatments.

- Substantiation: Maintain detailed records and receipts to support your deductions.

- Threshold: Deductions are permitted only if they exceed 7.5% of Adjusted Gross Income (AGI).

- Dependent Coverage: Medical expenses paid for dependents qualify for deductions, meeting certain criteria.

- Reimbursement Impact: Deductions may be reduced or eliminated if expenses are reimbursed.

- Itemization Necessity: Medical expense deductions require itemizing on your tax return.

Understanding these aspects is crucial for maximizing your tax savings. For instance, meticulous record-keeping ensures that you can substantiate your deductions when necessary. Additionally, strategic management of expenses can help you meet the AGI threshold. Remember, itemization is essential for claiming medical expense deductions, so consider this carefully when making tax-related decisions. Consulting with a tax professional can further enhance your understanding and ensure you take full advantage of these valuable deductions.

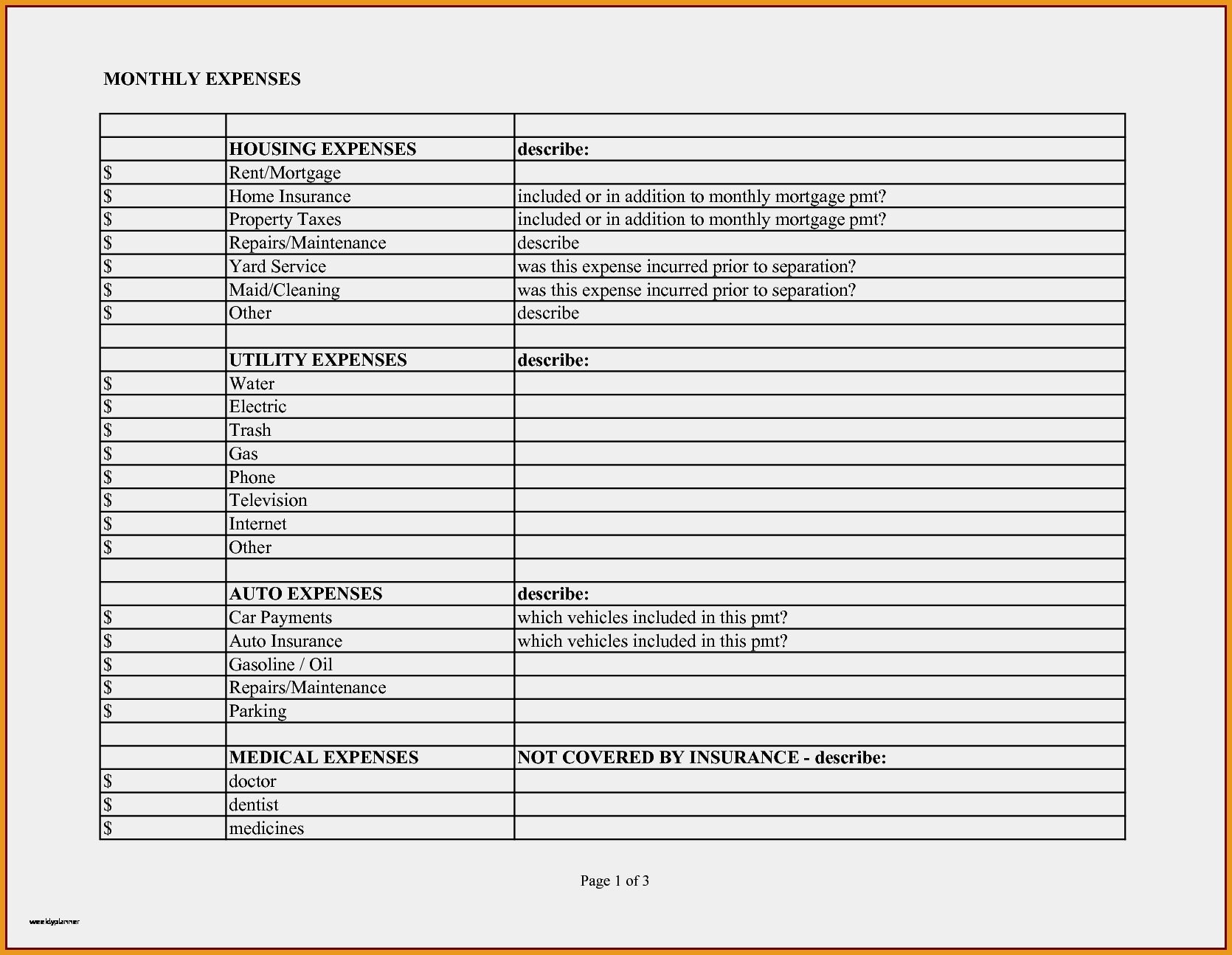

Business Expense Spreadsheet For Taxes Rental Property Tax with - Source db-excel.com

Maximize Your Tax Savings: A Comprehensive Guide To Medical Expense Deductions

Understanding the complexities of medical expense deductions is crucial for maximizing tax savings. These deductions reduce your overall taxable income, effectively lowering your tax liability. The Internal Revenue Service (IRS) allows deductions for eligible medical expenses that exceed 7.5% of your Adjusted Gross Income (AGI). These expenses include medical, dental, vision, and prescription drug costs, as well as insurance premiums, mileage, and parking fees related to medical appointments.

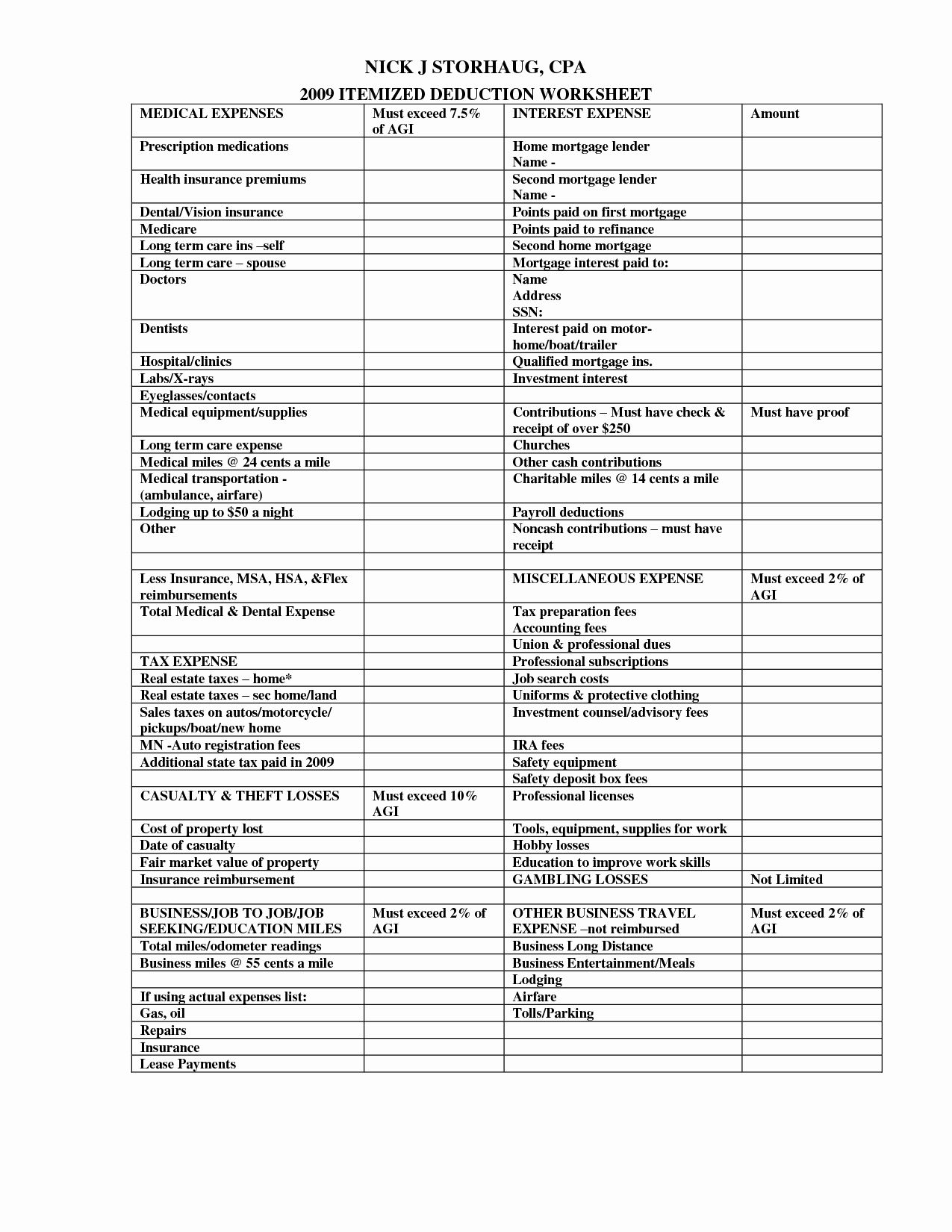

Truck Driver Tax Expense Deductions List - Source lessonschoolangelhoods.z21.web.core.windows.net

Claiming medical expense deductions requires meticulous record-keeping, including receipts, bills, and documentation of expenses. Failure to provide proper documentation may result in denied deductions. Additionally, the IRS sets limits on reimbursements from insurance or other sources, which can affect your total deductible amount. Navigating these regulations can be challenging, making professional tax advice invaluable.

Understanding medical expense deductions not only saves money on taxes but also ensures proper budgeting for healthcare expenses. By leveraging these deductions, taxpayers can optimize their financial well-being and plan for future medical needs.

| Type of Medical Expense | Deductibility |

|---|---|

| Medical and dental expenses | Eligible for deduction |

| Prescription drug costs | Eligible for deduction |

| Insurance premiums (health, dental, vision) | Eligible for deduction |

| Mileage and parking fees related to medical appointments | Eligible for deduction |

| Reimbursements from insurance | May reduce deductible amount |

Conclusion

Maximizing medical expense deductions requires careful planning and documentation. By understanding the IRS regulations and seeking professional guidance when needed, taxpayers can significantly reduce their tax liability. These deductions not only provide financial savings but also empower individuals to take control of their healthcare expenses and plan for their well-being.

Staying informed about tax laws and exploring additional tax-saving strategies is essential for optimizing financial outcomes. Utilizing resources such as the IRS website, tax professionals, and reputable financial advisors can help taxpayers navigate the complexities of tax deductions and make informed decisions that maximize their savings.