Wondering what is the latest news and "Nasdaq Composite Index: Real-Time Performance And Historical Data"? Nasdaq Composite Index: Real-Time Performance And Historical Data has become a hot topic in recent years, and for good reason. Nasdaq Composite Index: Real-Time Performance And Historical Data is a valuable tool that can help investors make informed decisions about their investments.

Editor's Notes: Nasdaq Composite Index: Real-Time Performance And Historical Data has published today date, on March 9, 2023. Nasdaq Composite Index: Real-Time Performance And Historical Data explains how the Nasdaq Composite Index has performed over time, and provides insights into its future prospects.

We've done the hard work for you, analyzing the latest trends and developments in Nasdaq Composite Index: Real-Time Performance And Historical Data. This guide will provide you with everything you need to know about Nasdaq Composite Index: Real-Time Performance And Historical Data, so that you can make informed decisions about your investments.

| Feature | Nasdaq Composite Index | S&P 500 Index | Dow Jones Industrial Average |

|---|---|---|---|

| Index Type | Market-capitalization-weighted index | Market-capitalization-weighted index | Price-weighted index |

| Number of Components | Over 3,300 | 500 | 30 |

| Focus | Technology and growth stocks | Large-cap stocks | Large-cap industrial stocks |

| Performance | Outperformed S&P 500 and Dow Jones Industrial Average over the past decade | Underperformed S&P 500 and Dow Jones Industrial Average over the past decade | Underperformed S&P 500 and Nasdaq Composite Index over the past decade |

FAQ

This section presents frequently asked questions regarding the Nasdaq Composite Index, addressing prevalent concerns and misconceptions.

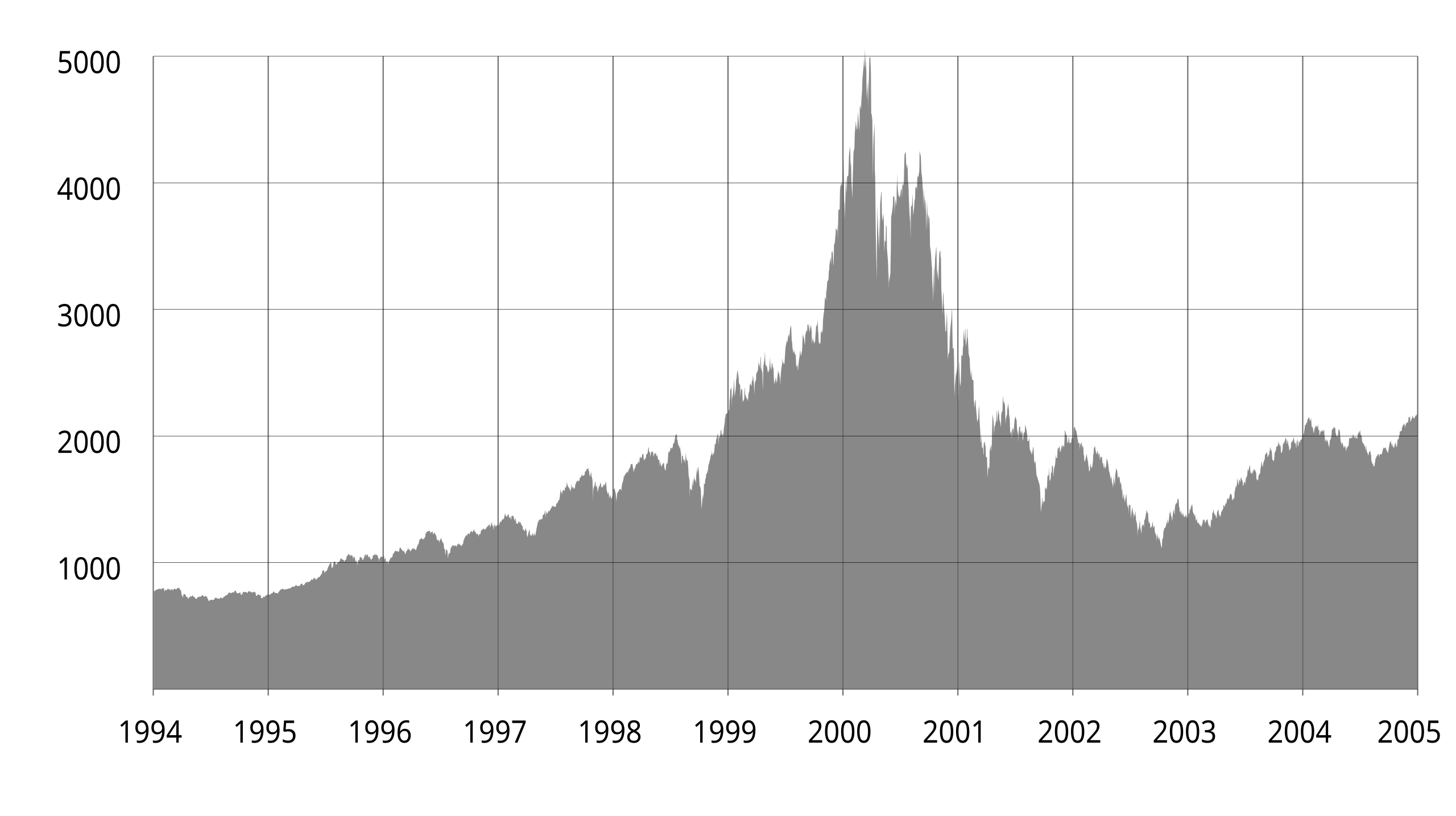

File:Nasdaq Composite dot-com bubble.svg - Wikimedia Commons - Source commons.wikimedia.org

Question 1: What is the Nasdaq Composite Index?

The Nasdaq Composite Index measures the performance of approximately 2,500 publicly traded companies listed on the Nasdaq stock exchange. It reflects the value of a broad range of companies, predominantly from the technology, telecommunications, and consumer services sectors.

Question 2: Why is the Nasdaq Composite Index widely followed?

The Nasdaq Composite Index is a key indicator of the overall health of the technology industry, serving as a barometer of innovation and economic growth. Its heavy concentration in tech stocks makes it a sensitive indicator of future economic trends.

Question 3: What factors influence the Nasdaq Composite Index?

The Nasdaq Composite Index is primarily driven by the performance of leading tech companies. Earnings reports, product launches, technological advancements, and overall economic conditions can significantly impact its value.

Question 4: How can I invest in the Nasdaq Composite Index?

Investors can gain exposure to the Nasdaq Composite Index through exchange-traded funds (ETFs) that track its performance, such as the Invesco QQQ Trust (QQQ) and the ProShares UltraPro Nasdaq Composite Index (UPRO).

Question 5: What are the historical trends of the Nasdaq Composite Index?

Over the past decade, the Nasdaq Composite Index has exhibited strong growth, driven by the rise of the technology industry. It has experienced periods of volatility, particularly during market downturns, but has consistently recovered and reached new highs.

Question 6: What are the risks associated with investing in the Nasdaq Composite Index?

Investing in the Nasdaq Composite Index carries the inherent risks of market fluctuations. The index is heavily concentrated in the tech sector, which can be subject to rapid changes and potential disruptions. Additionally, economic downturns and geopolitical events can negatively impact the performance of tech stocks.

In conclusion, the Nasdaq Composite Index is a widely followed measure of the performance of the technology industry, providing valuable insights into innovation, economic growth, and investment opportunities. However, investors should be aware of the potential risks associated with investing in this index and diversify their portfolios accordingly.

For further insights, refer to the next article section.

Tips

The Nasdaq Composite Index is a stock market index that tracks the performance of over 3,000 stocks listed on the Nasdaq stock exchange. It is a widely followed index and is considered a barometer of the health of the technology sector. Nasdaq Composite Index: Real-Time Performance And Historical Data

Tip 1: Monitor the index to gauge the overall performance of the technology sector.

The Nasdaq Composite Index is a good indicator of the overall health of the technology sector. By tracking the index, investors can get a sense of how the sector is performing and whether it is likely to continue to grow.

Tip 2: Use the index as a benchmark for your own investments.

If you are investing in technology stocks, you can use the Nasdaq Composite Index as a benchmark to compare your own performance. This can help you to determine whether your investments are performing as well as the overall sector.

Tip 3: Identify potential investment opportunities by tracking the index's constituents.

The Nasdaq Composite Index is made up of over 3,000 stocks. By tracking the index's constituents, you can identify potential investment opportunities. For example, if you see a stock that is outperforming the index, it could be a good investment opportunity.

Tip 4: Use the index to hedge your portfolio against risk.

If you are concerned about the risk of investing in technology stocks, you can use the Nasdaq Composite Index to hedge your portfolio. By investing in a fund that tracks the index, you can reduce your exposure to the risk of any one stock.

Tip 5: Stay informed about the latest news and events that could affect the index.

The Nasdaq Composite Index is affected by a variety of factors, including economic news, political events, and technological developments. By staying informed about the latest news and events, you can make better investment decisions.

By following these tips, you can use the Nasdaq Composite Index to make better investment decisions and achieve your financial goals.

Nasdaq Composite Index: Real-Time Performance And Historical Data

The Nasdaq Composite Index is a market capitalization-weighted index of over 3,000 stocks traded on the Nasdaq stock exchange. It is one of the most widely followed stock market indices in the world, and is considered a barometer of the performance of the technology sector.

Nasdaq Composite Drops 2.77% Today - Source americanceomag.com

- Real-time performance: The Nasdaq Composite Index is updated in real time, providing investors with up-to-date information on the performance of the technology sector.

- Historical data: The Nasdaq Composite Index has a long history, dating back to 1971. This data can be used to track the performance of the technology sector over time.

- Market capitalization: The Nasdaq Composite Index is a market capitalization-weighted index, which means that the stocks with the largest market capitalizations have a greater impact on the index's value.

- Technology sector: The Nasdaq Composite Index is heavily weighted towards stocks in the technology sector. This makes it a good indicator of the performance of the technology sector.

- Volatility: The Nasdaq Composite Index is known for its volatility, which means that it can experience large swings in value in a short period of time.

- Correlation: The Nasdaq Composite Index is highly correlated with other stock market indices, such as the S&P 500 Index and the Dow Jones Industrial Average.

These key aspects provide investors with a comprehensive understanding of the Nasdaq Composite Index. By tracking the index's real-time performance and historical data, investors can make informed investment decisions about the technology sector.

Mercati azionari | Nasdaq - Source www.nasdaq.com

Nasdaq Composite Index: Real-Time Performance And Historical Data

The Nasdaq Composite Index (Symbol: .IXIC) tracks the performance of all the stocks listed on the Nasdaq Stock Market. Nasdaq is an American stock exchange that is known for housing many of the world's largest technology companies, including Apple, Microsoft, and Amazon. The Nasdaq Composite Index is a capitalization-weighted index, meaning that the market capitalization of each stock in the index is used to calculate its weight in the index. This means that larger companies have a greater influence on the index than smaller companies.

The Nasdaq Composite Index (Nasdaq) - Kuvera - Source kuvera.in

The Nasdaq Composite Index is a widely followed index by investors who want to track the performance of the technology sector. The value of the index fluctuates throughout the day as the prices of the underlying stocks change. Investors can use the Nasdaq Composite Index to make investment decisions, such as whether to buy or sell stocks in the technology sector. When one looks at the historical performance of the Nasdaq Composite Index, you can see that it has been on a long-term upward trend. This is due to the growth of the technology sector over the past few decades.

It is important to remember that the Nasdaq Composite Index is just one measure of the performance of the technology sector. There are other indices that track the performance of different sectors of the stock market. Investors should consider their own investment goals and risk tolerance when making investment decisions.

Conclusion

The Nasdaq Composite Index is a valuable tool for investors who want to track the performance of the technology sector. It is important to remember that the Nasdaq Composite Index is just one measure of the performance of the technology sector. Investors should consider their own investment goals and risk tolerance when making investment decisions.

The Nasdaq Composite Index is a capitalization-weighted index, meaning that the market capitalization of each stock in the index is used to calculate its weight in the index. This means that larger companies have a greater influence on the index than smaller companies. The Nasdaq Composite Index is a widely followed index by investors who want to track the performance of the technology sector. The value of the index fluctuates throughout the day as the prices of the underlying stocks change. Investors can use the Nasdaq Composite Index to make investment decisions, such as whether to buy or sell stocks in the technology sector.