Looking for an in-depth analysis of Sekisui Chemical Corporation's stock performance and market insights?

Editor's Notes: "Sekisui Chemical Corporation: Stock Price Analysis And Market Insights" have published today, it will provide valuable insights into the company's financial health, growth prospects, and competitive landscape.

Our team has done extensive research and analysis, gathering information from various sources to provide you with comprehensive "Sekisui Chemical Corporation: Stock Price Analysis And Market Insights".

Key Differences or Key takeaways

Transition to main article topics

FAQ

Sekisui Chemical Corporation is a global company with a diverse portfolio of businesses. The company's stock price is closely watched by investors who are interested in tracking the performance of the company and the overall market. This FAQ section provides answers to some of the most common questions about Sekisui Chemical Corporation's stock price analysis and market insights.

Question 1: What factors affect the stock price of Sekisui Chemical Corporation?

The stock price of Sekisui Chemical Corporation is affected by a number of factors, including the company's financial performance, the overall market conditions, and the demand for the company's products and services.

Question 2: How can I track the stock price of Sekisui Chemical Corporation?

You can track the stock price of Sekisui Chemical Corporation on a number of financial websites, including Yahoo Finance and Google Finance.

![Investing Insights & Market Analysis [Issue #26: May 2024] Investing Insights & Market Analysis [Issue #26: May 2024]](https://substackcdn.com/image/fetch/f_auto,q_auto:good,fl_progressive:steep/https://substack-post-media.s3.amazonaws.com/public/images/e5255500-36be-40f0-942f-da2e4515c8d6_2459x1379.png)

Investing Insights & Market Analysis [Issue #26: May 2024] - Source www.thefinancenewsletter.com

Question 3: What are some of the key insights about the market for Sekisui Chemical Corporation's products and services?

The market for Sekisui Chemical Corporation's products and services is expected to grow in the coming years, due to the increasing demand for the company's products in the automotive, construction, and electronics industries.

Question 4: What are some of the risks associated with investing in Sekisui Chemical Corporation?

There are a number of risks associated with investing in Sekisui Chemical Corporation, including the risk of the company's financial performance declining, the risk of the overall market conditions worsening, and the risk of the demand for the company's products and services decreasing.

Question 5: How can I stay up-to-date on the latest news and events that could affect the stock price of Sekisui Chemical Corporation?

You can stay up-to-date on the latest news and events that could affect the stock price of Sekisui Chemical Corporation by visiting the company's website or following the company on social media.

Question 6: Where can I find more information about Sekisui Chemical Corporation?

You can find more information about Sekisui Chemical Corporation on the company's website or by contacting the company's investor relations department.

Tips

Discover Sekisui Chemical Corporation: Stock Price Analysis And Market Insights and gain a deeper understanding of the company's performance and market dynamics.

Tip 1: Monitor key financial metrics such as revenue, earnings per share (EPS), and profit margins to assess the company's financial health.

Tip 2: Analyze industry trends and competitive landscape to identify potential risks and opportunities for Sekisui Chemical Corporation.

Tip 3: Evaluate the company's management team and corporate governance practices to gauge its strategic vision and execution capabilities.

Tip 4: Pay attention to market sentiment and investor sentiment to understand market expectations and potential price movements.

Tip 5: Seek professional advice from financial analysts and investment professionals to gain insights and make informed investment decisions.

Tip 6: Regularly review and update your investment thesis to ensure it remains aligned with changing market conditions.

Tip 7: Utilize technical analysis techniques such as chart patterns and indicators to identify potential trading opportunities.

Tip 8: Diversify your portfolio by investing in different asset classes and sectors to mitigate risks.

For more comprehensive insights into Sekisui Chemical Corporation, consider exploring the full article.

By incorporating these tips into your investment strategy, you can make informed decisions and potentially enhance your investment returns.

Sekisui Chemical Corporation: Stock Price Analysis And Market Insights

Understanding the key aspects of Sekisui Chemical Corporation's stock price analysis and market insights is crucial for investors and analysts.

- Financial Performance: Sekisui Chemical's financial performance, including revenue, profit margins, and cash flow, significantly impacts its stock price.

- Industry Trends: Changes in the chemical industry, such as technological advancements or market demand fluctuations, affect Sekisui Chemical's stock performance.

- Economic Conditions: Macroeconomic factors like interest rates, inflation, and economic growth influence the overall demand for chemical products and Sekisui Chemical's stock price.

- Company Strategy: Sekisui Chemical's strategic decisions, such as mergers and acquisitions, new product development, and marketing initiatives, can drive stock price movements.

- Analyst Ratings: Recommendations and price targets from financial analysts can influence investor sentiment and affect stock prices.

- Technical Analysis: Technical indicators and chart patterns can provide insights into potential stock price trends and trading opportunities.

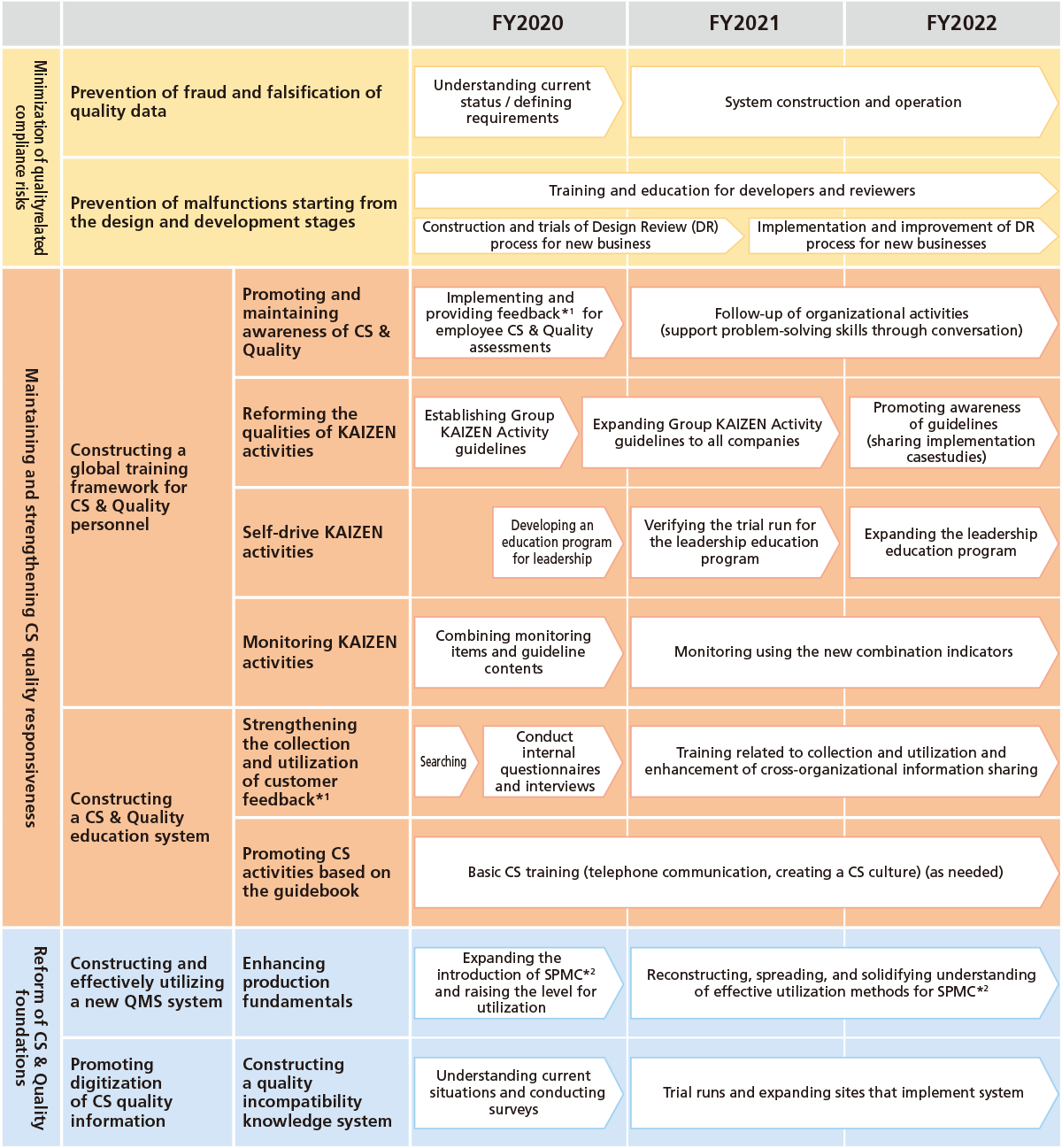

Improving CS & Quality|Sustainability Report 2023|SEKISUI CHEMICAL CO.,LTD - Source www.sekisuichemical.com

By considering these key aspects, investors can gain a comprehensive understanding of Sekisui Chemical Corporation's stock price dynamics and make informed trading decisions. For instance, strong financial performance and positive industry outlooks could indicate potential stock price growth, while economic headwinds or company-specific challenges may lead to stock price declines.

How to read stock charts-Learn Stock trading-Best Stock Charts - Source fitzstock.com

Sekisui Chemical Corporation: Stock Price Analysis And Market Insights

Sekisui Chemical Corporation is a leading global manufacturer of plastics, chemicals, and other materials. The company's stock price has been on a steady upward trend in recent years, due to strong demand for its products and a positive outlook for the future. However, there are a number of factors that could affect the company's stock price in the future, including the global economy, competition, and regulatory changes.

TELF AG: Stay Ahead of the Curve with Market Insight: How In-Depth - Source telf.ch

The global economy is a major factor that could affect Sekisui Chemical Corporation's stock price. If the global economy slows down, demand for the company's products could decrease, which could lead to a decline in the stock price. Competition is another factor that could affect the company's stock price. Sekisui Chemical Corporation faces competition from a number of other companies, including Dow Chemical, DuPont, and BASF. If these companies gain market share, it could lead to a decline in Sekisui Chemical Corporation's stock price.

Regulatory changes could also affect Sekisui Chemical Corporation's stock price. The company's products are subject to a number of regulations, both in Japan and abroad. Changes to these regulations could increase the cost of doing business for Sekisui Chemical Corporation, which could lead to a decline in the stock price.

Despite these risks, Sekisui Chemical Corporation is a well-positioned company with a strong track record of success. The company has a number of competitive advantages, including its strong brand recognition, its global reach, and its commitment to innovation. These advantages should help the company to continue to grow and prosper in the future.

| Factor | Impact on Stock Price | Outlook |

|---|---|---|

| Global economy | Demand for products could decrease | Positive |

| Competition | Market share could decrease | Neutral |

| Regulatory changes | Cost of doing business could increase | Negative |

Conclusion

Overall, Sekisui Chemical Corporation is a well-positioned company with a strong track record of success. The company has a number of competitive advantages, including its strong brand recognition, its global reach, and its commitment to innovation. These advantages should help the company to continue to grow and prosper in the future.

However, there are a number of factors that could affect Sekisui Chemical Corporation's stock price in the future, including the global economy, competition, and regulatory changes. Investors should be aware of these risks before investing in the company.