Unveiling Government Bond Yields: Your Ultimate Guide to Understanding and Analyzing Government Debt

Editor's Notes: Unveiling Government Bond Yields: A Comprehensive Guide has been published today to provide a comprehensive understanding of government bond yields to help investors make informed decisions.

At [Your Organization], we understand the importance of providing our readers with in-depth insights into financial markets. Through rigorous analysis and extensive research, we have compiled "Unveiling Government Bond Yields: A Comprehensive Guide" to empower you with the knowledge you need to navigate the complex world of government bonds.

Key Differences: Unveiling Government Bond Yields

| Feature | Unveiling Government Bond Yields | Traditional Resources |

|---|---|---|

| Comprehensiveness | Covers all aspects of government bond yields, from fundamentals to advanced strategies. | Often limited to basic concepts or specific yield types. |

| Analysis and Insights | Provides in-depth analysis and insights into yield movements and market trends. | Typically lacks detailed analysis or forward-looking perspectives. |

| Practical Applications | Offers practical guidance on utilizing government bond yields in investment strategies. | May not offer specific or actionable recommendations. |

Unveiling the Main Article Topics

FAQ

This comprehensive FAQ section provides answers to frequently asked questions about government bond yields, offering clarity and insights into this complex topic.

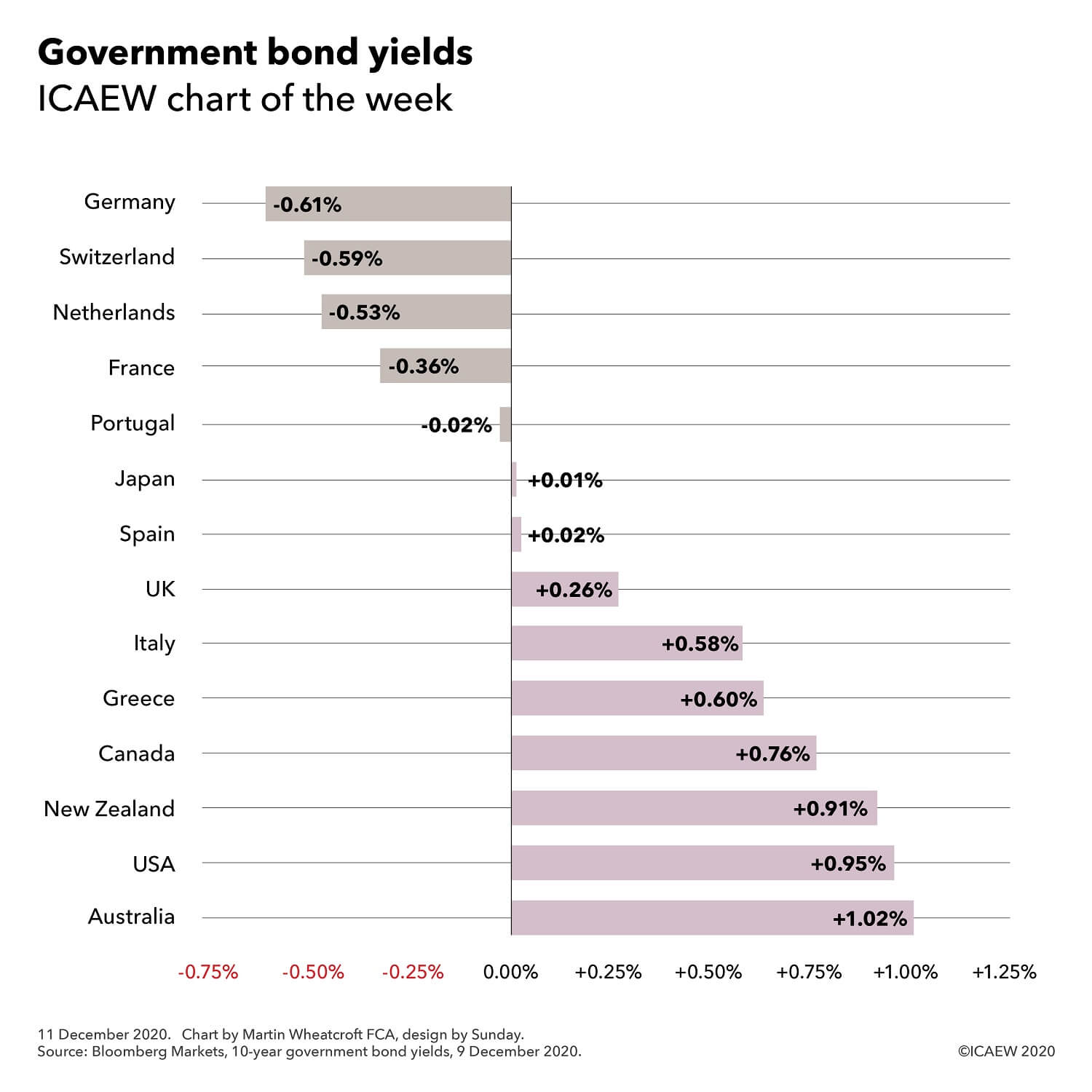

Chart of the week: Government bond yields | ICAEW - Source www.icaew.com

Question 1: What is a government bond yield?

A government bond yield is the annualized return an investor receives from holding a government bond until maturity. It represents the interest rate paid by the government on the borrowed funds.

Question 2: How are bond yields determined?

Bond yields are influenced by various factors, including the prevailing interest rate environment set by central banks, economic conditions, supply and demand dynamics, and investor sentiment.

Question 3: Why are government bond yields important?

Government bond yields serve as benchmarks for other interest rates, influencing borrowing costs for businesses and individuals. They also provide insights into market expectations about future economic growth and inflation.

Question 4: What is the difference between nominal and real yields?

Nominal yields reflect the stated interest rate on a bond, while real yields adjust for inflation. Real yields indicate the actual return investors receive after accounting for the erosion of purchasing power.

Question 5: How can investors use bond yields to make informed decisions?

By understanding bond yields and their implications, investors can make informed decisions about allocating their investments, managing risk, and achieving their financial goals.

Question 6: Where can investors find information about government bond yields?

Numerous sources provide data and analysis on government bond yields, including financial news outlets, government websites, and investment platforms.

In conclusion, government bond yields are a crucial aspect of financial markets, providing insights into the economy, influencing interest rates, and guiding investment decisions. By understanding the nuances of bond yields, investors can navigate financial markets with greater confidence and make informed choices that align with their investment objectives.

For further insights, explore the following sections:

Tips

Explore Unveiling Government Bond Yields: A Comprehensive Guide to gain a deeper understanding on government bond yields and how they work.

Tip 1: Understand the roles of central banks in setting bond yields.

Central banks play a crucial role in influencing bond yields through monetary policy tools such as interest rate adjustments and quantitative easing.

Tip 2: Track economic indicators to anticipate yield movements.

Economic data like inflation rates, GDP growth, and unemployment levels can provide insights into future yield trends.

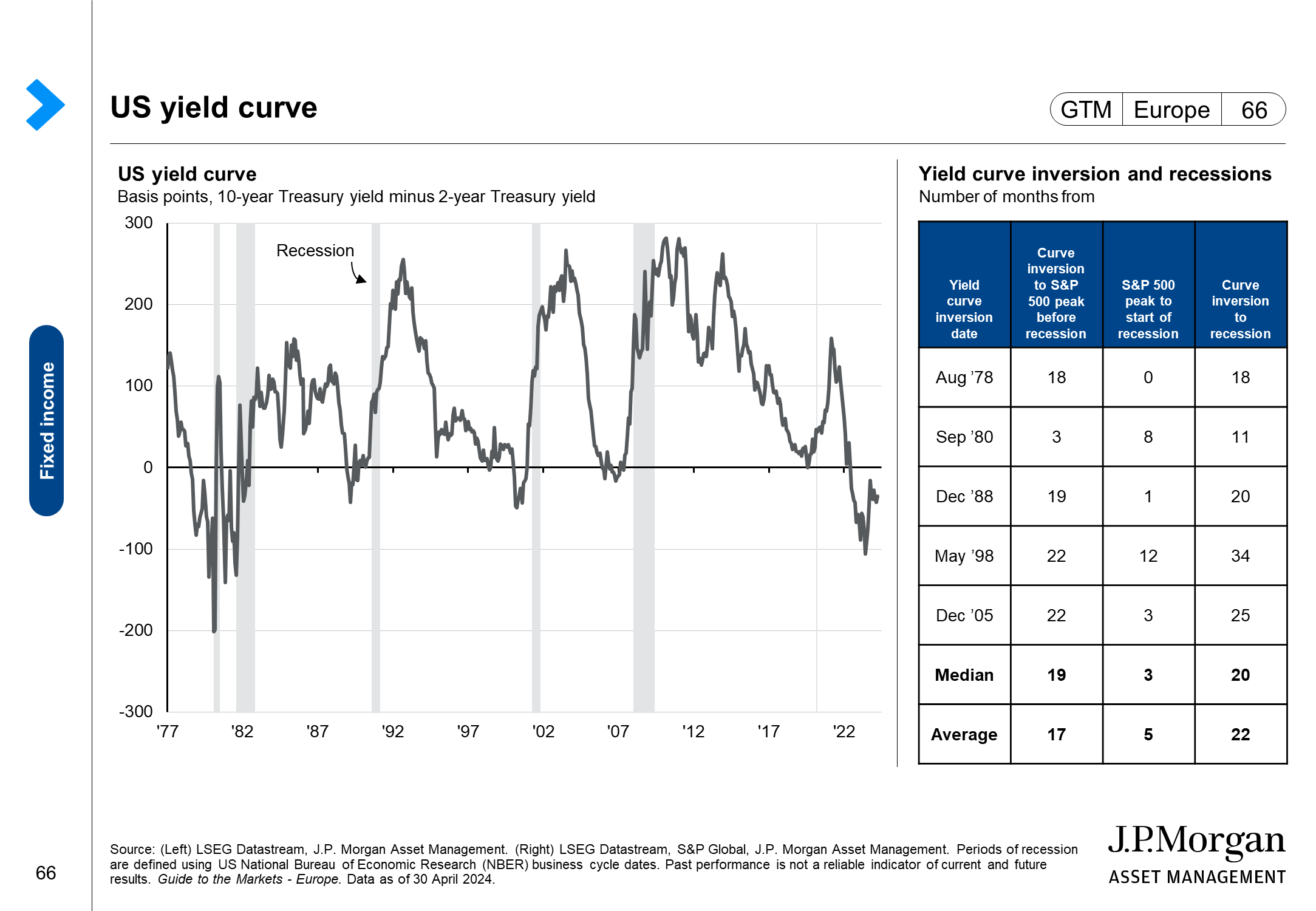

Tip 3: Consider the impact of yield curves on investment strategies.

The shape of the yield curve can indicate market expectations and guide investment decisions, such as allocating between different maturities.

Tip 4: Factor in risk premiums when evaluating bond yields.

Government bonds may carry different risk premiums depending on the country's creditworthiness and political stability, which can affect their yields.

Tip 5: Utilize bond yield calculators and online resources.

Various tools and platforms can assist in calculating bond yields, comparing different issues, and accessing up-to-date market data.

These tips offer valuable insights for mastering the complexities of government bond yields, allowing investors and financial professionals to make informed decisions.

By following these tips, you can enhance your understanding of government bond yields and navigate the bond market confidently.

Unveiling Government Bond Yields: A Comprehensive Guide

Government bond yields, reflecting the interest rates paid on government debt, are crucial gauges of economic health and financial markets. Unveiling their complexity requires a comprehensive understanding of key aspects:

- Definition: Understanding the nature of government bond yields as interest payments on government debt.

- Determinants: Identifying factors influencing yields, such as inflation expectations and economic growth.

- Market Impact: Analyzing the impact of bond yields on investment decisions and overall market sentiment.

- Risk Assessment: Evaluating the credit risk associated with government bonds and its implications for investors.

- Yield Curve Analysis: Interpreting the yield curve's shape to predict future economic trends.

- Policy Implications: Understanding how governments utilize bond yields to manage monetary policy and influence borrowing costs.

European 10-Year Government Bond Yields (01-12-2023) : r/europe - Source www.reddit.com

These aspects provide a comprehensive framework for unveiling government bond yields. For instance, recognizing their market impact highlights how yields affect stock prices and currency exchange rates. Moreover, yield curve analysis aids in forecasting recessions and economic expansions. By considering these factors, investors can make informed decisions based on the current and future state of bond yields.

Table 1 from Empirical Models of Chinese Government Bond Yields - Source www.semanticscholar.org

Unveiling Government Bond Yields: A Comprehensive Guide

Government bond yields are a crucial element of the financial system, impacting investment decisions, economic growth, and government borrowing costs. This comprehensive guide delves into the complexities of government bond yields, providing a detailed understanding of their calculation, interpretation, and significance.

Global government bond yields - Source am.jpmorgan.com

Understanding government bond yields is essential for investors seeking to maximize returns and manage risk. Bond yields reflect market expectations for inflation, economic growth, and government stability. Bond yields can influence the cost of borrowing for businesses and individuals, affecting economic activity and consumer spending.

The connection between government bond yields and other financial instruments is intricate. Higher bond yields can lead to lower stock prices, as investors seek higher returns from fixed-income investments. Currency exchange rates can also be affected, as foreign investors may be drawn to higher-yielding government bonds.

Government bond yields play a central role in monetary policy. Central banks use bond yields to influence inflation, interest rates, and economic growth. By purchasing or selling government bonds, central banks can increase or decrease the supply of money in the economy, impacting bond yields and overall financial conditions.

To accurately interpret government bond yields, it's essential to consider various factors, including:

- The maturity of the bond

- The creditworthiness of the government issuing the bond

- Market expectations for future economic conditions

This comprehensive guide provides valuable insights into government bond yields, enabling investors, policymakers, and financial professionals to make informed decisions. Understanding the intricacies of government bond yields is crucial for navigating the complex and ever-changing financial landscape.

Conclusion

Government bond yields are indispensable in understanding financial markets, economic conditions, and government borrowing. This guide has unveiled the complexities of government bond yields, providing a roadmap for deciphering their impact on investments, economic growth, and monetary policy. By staying abreast of government bond yield movements, investors and policymakers can make informed decisions to mitigate risks, maximize returns, and contribute to economic prosperity.

As the financial landscape continues to evolve, the significance of government bond yields will only grow. This comprehensive guide serves as a valuable resource for anyone seeking a deeper understanding of this critical financial indicator.